The US dollar versus the Japanese yen currency pair may have extended a little too much in a very short timespan.

Long-term perspective

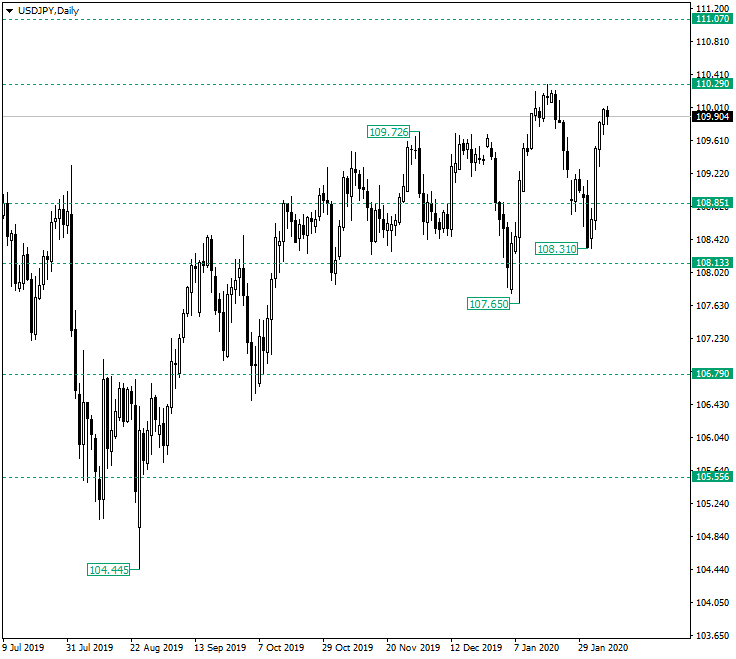

After confirming the 108.13 level via the false break that impressed the low at 107.65, the price appreciated until the 110.29 resistance level.

From there, a depreciation that extended until 108.31 came into play, thus printing a higher low with respect to the previous one, 107.65, respectively.

The low of 108.31 fueled a strong rally that seems to be capped at the 110.00 psychological level — not highlighted on the chart.

Signs of a possible bearish takeover can be seen in the bodies of the January 4 to January 6 candles, as their amplitude diminishes. Even more, on January 6, the price could not go higher than the 110.00 mark.

In such a context, a strong bearish comeback is likely. This could begin from just under the 110.00 level or after a false piercing of it, with the extension of the price not further than 110.29.

In such a scenario, the area made evident by the 109.72 high does not pose a threat for the bears, as the strong start given by the confirmation as a resistance of the 110.00 psychological level would be enough to dilute any bullish stands.

This perspective aims for the 108.85 level first, followed by 108.13.

Only if the bulls manage to conquer 110.29, then and advancement towards 111.07 would be made possible.

Short-term perspective

After the price was not able to assign a supportive role to the 109.75 level, it depreciated until 108.43, from where the bulls took over, driving the price back above 109.75.

If the bulls fail for the second time to make the price bounce off of 109.75, then the levels of 109.19 and 108.43 may serve as bearish profit taking areas.

On the other hand, if 109.75 does offer support, a retest of 110.22 is in the cards.

Levels to keep an eye on:

D1: 110.00 110.29 108.85 108.13 111.07

H4: 109.75 109.19 108.43 110.22

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.