- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: September 28, 2020

September 28

September 282020

Australian Dollar Gains on Improving Sentiment, Changing Outlook for Interest Rate Cut

The Australian dollar was extremely strong on Monday, second only to the Great Britain pound. There were two likely reasons for that. The first one was the positive general market sentiment, which was favoring riskier assets. The second one was the changing outlook for the timing of an interest rate cut from the Reserve Bank of Australia. Investors were in a positive mood at the start of the week as the rally in the stock market that has started on Friday […]

Read more September 28

September 282020

Sterling Firms on Brexit Optimism, Monetary Policy Outlook

The Great Britain pound was the strongest among the major currencies on the Forex market today thanks to comments from a central bank official and hopes for a trade deal between the United Kingdom and the European Union. While the sterling has trimmed its gains by now, it is still trading above the opening level at the time of writing. Bank of England Deputy Governor Dave Ramsden said that he thinks the BoE does not need […]

Read more September 28

September 282020

Chinese Yuan Looks to Test 52-Week High as PBoC Pumps More Liquidity

The Chinese yuan paused its rally last week after touching a 52-week high of 6.75 against the US dollar. The yuan is looking to restart its push against the greenback to kick off the trading week, driven by additional liquidity in the banking system and a recovering economy. Can the yuan maintain its upward trajectory? On Monday, the People’s Bank of China (PBoC) announced that it would inject $5.86 billion into the Chinese market […]

Read more September 28

September 282020

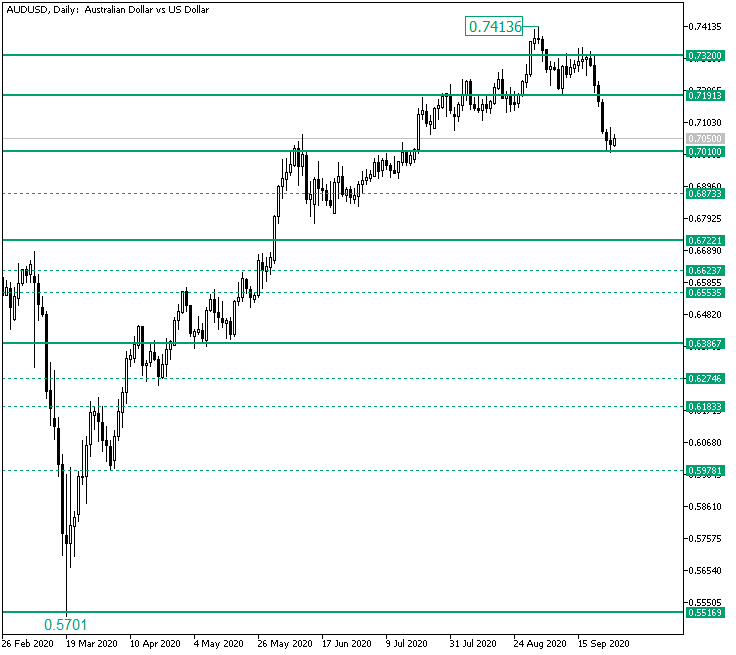

AUD/USD Touched 0.7010. Are the Bears Done?

The Australian versus the US dollar currency pair seems to be in bearish hands. Are the bulls anywhere near? Long-term perspective The appreciation from the 0.5701 low climbed to as high as 0.7413. From there, it retraced under the 0.7320 firm resistance area, which rendered the price-action as a false break. On September 9, a bullish engulfing was printed after the price was repelled by 0.7191. However, the facts that the pattern materialized after a false […]

Read more