- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: October 7, 2020

October 7

October 72020

Sterling Pound Rallies As UK Govt Prepares for No-Deal Brexit

The Sterling pound today rallied against the dollar on positive investor sentiment before falling on Brexit jitters after comments from the Irish government. The GBP/USD currency pair later rallied even after the UK said that it was actively preparing for a no-deal Brexit scenario as the October 15 deadline approaches. The GBP/USD currency pair today fell to a low of 1.2846 in the early American session before rallying close to its daily highs […]

Read more October 7

October 72020

Japanese Yen Weakens As BoJ Warns of âVery Highâ Uncertainty Amid COVID-19 Pandemic

The Japanese yen is under pressure in the middle of the trading week as the central bank warned that economic uncertainty remains âvery highâ because of the coronavirus pandemic. But the yen could find support on macroeconomic data suggesting the contraction in the worldâs third-largest economy might have subsided. Could the traditional safe-haven asset continue its strong 2020 in the final quarter? Speaking in a video message to an annual meeting of securities firms, Bank of Japan (BoJ) […]

Read more October 7

October 72020

Euro Strong After Market Sentiment Recovers

The euro was strong today, rising against all other most-traded currencies, with the exception of the Australian dollar. The possible reason for the rally was the market sentiment, which was recovering after confusing tweets from US President Donald Trump. Macroeconomic reports released in the eurozone today were mixed. Markets entered a risk-off mode after the news broke out that Trump halts negotiations with Democrats about a big stimulus […]

Read more October 7

October 72020

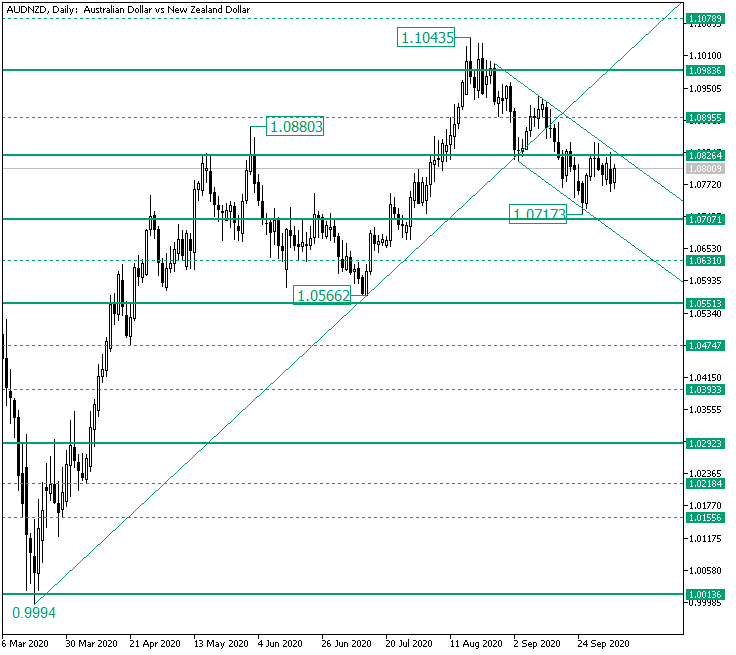

AUD/NZD Prepared to Break 1.0826?

The Australian versus the New Zealand dollar currency pair seems to be willing to go towards the north. Do the bulls have the power to do so? Long-term perspective The appreciation from the 0.9994 low extended, after a correction phase bounded by the 1.0880 high and 1.0566 low, respectively, to 1.1043. Noteworthy is that the 1.1043 high comes outside of the resistance area that the firm level of 1.0983 represents. And because — after such a departure — the bulls […]

Read more