- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Fundamental Analysis

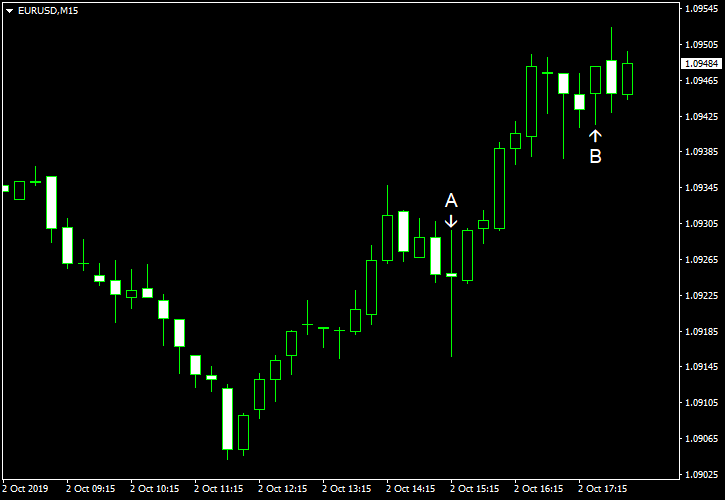

October 2

October 22019

EUR/USD Rebounds Despite Employment Growth Matching Expectations

EUR/USD was falling earlier today but has bounced by now, rising above the opening level. The bounce happened despite decent US employment data that matched expectations. ADP employment rose by 135k in September, close the to the median forecast of 140k but less than in August — 157k (the reading which itself got a negative revision from 195k). (Event A on the chart.) US crude oil inventories climbed by 3.1 million last […]

Read more October 1

October 12019

EUR/USD Climbs After ISM Manufacturing Declines Unexpectedly

EUR/USD was moving back and forth today, starting the session with a gradual decline, moving upward afterward, retreating yet again but shooting to the upside after the manufacturing report from the Institute for Supply Management showed an unexpected decline of the sector. Markit manufacturing PMI rose to 51.1 in September from 50.3 in August according to the final estimate. Market participants were expecting the index to be a bit lower at the 51.0 level showed by the preliminary […]

Read more September 27

September 272019

EUR/USD Rises as US Consumer Spending & Core PCE Inflation Slow

EUR/USD gained today after the release of US macroeconomic data that showed that growth of consumer spending slowed sharply and core PCE inflation also slowed unexpectedly. Not all reports were bad. The consumer sentiment improved much more than was anticipated. But that did not prevent the currency pair from continuing to rally. Personal income and spending rose in August. Income rose 0.4%, matching expectations, […]

Read more September 26

September 262019

EUR/USD Decline After US Pending Home Sales Beat Expectations

EUR/USD was attempting to rise today but reversed gains after the release of better-than-expected US pending home sales. USD GDP rose 2.0% in Q2 2019 according to the third and final estimate. It was unchanged from the preliminary estimate and matched forecasts. GDP expanded 3.1% in Q1. (Event A on the chart.) Initial jobless claims were at a seasonally adjusted level of 213k last week, whereas experts had predicted them to stay […]

Read more September 25

September 252019

EUR/USD Sinks as Markets Discard Trump Impeachment Threat

EUR/USD sank today as markets shrugged off the threat of impeachment of US President Donald Trump. Yesterday’s hardline comments from Trump about China put markets in a mild risk-averse mood. The currency pair accelerated its decline after the release of better-than-expected housing data in the United States. New home sales were at the seasonally adjusted annual rate of 713k in August, up from the revised July rate of 666k (635k before the revision). […]

Read more September 24

September 242019

EUR/USD Rises After All US Indicators Miss Expectations

EUR/USD rose today and extended its rally after US data came out universally disappointing. S&P/Case-Shiller home price index rose 2.0% in July, year-on-year. Analysts were expecting the same 2.2% rate of growth as in June. Mont-on-month, the index was up 0.1%. (Event A on the chart.) Consumer confidence dropped to 125.1 in September from 134.2 in August (revised down from 135.1). Experts had predicted the indicator to stay unchanged. (Event […]

Read more September 23

September 232019

EUR/USD Drops on Extremely Disappointing Eurozone PMIs

EUR/USD declined during Monday’s trading session. While the fact that Chinese officials cut short their visit to the United States made market participants question whether the US-China trade negotiations are falling apart, the main reason for the weakness of the currency pair was domestic macroeconomic data. Markit released PMIs for the eurozone today, and all of them came short of expectations. As for US data, both Markit manufacturing PMI and Markit services […]

Read more September 19

September 192019

EUR/USD Rises Following Drop Caused by FOMC Announcement

EUR/USD reversed its movement, rising today following yesterday’s drop caused by the hawkish interest rate cut by the Federal Open Market Committee. Markets are still trying to digest the FOMC statement and understand whether the cut was the end of the mid-cycle adjustment. As for today’s US macroeconomic data, it was mixed, giving no edge to the dollar. Philadelphia Fed manufacturing index dropped to 12.0 in September from 16.8 in August. Analysts had […]

Read more September 18

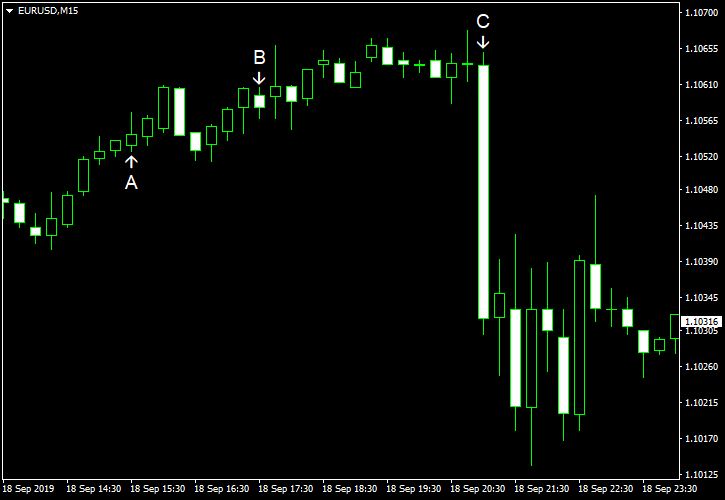

September 182019

EUR/USD Drops After FOMC Slashes Rates, Doesn’t Promise More Cuts

EUR/USD dropped today after the Federal Open Market Committee performed an interest rate cut. While markets were anticipating such move was for some time now, ahead of the announcement doubts started to creep in. And while the Committee did make a cut after all, markets considered the statement to be more hawkish than was expected. Moreover, FOMC projections did not show more cuts both in this year […]

Read more September 17

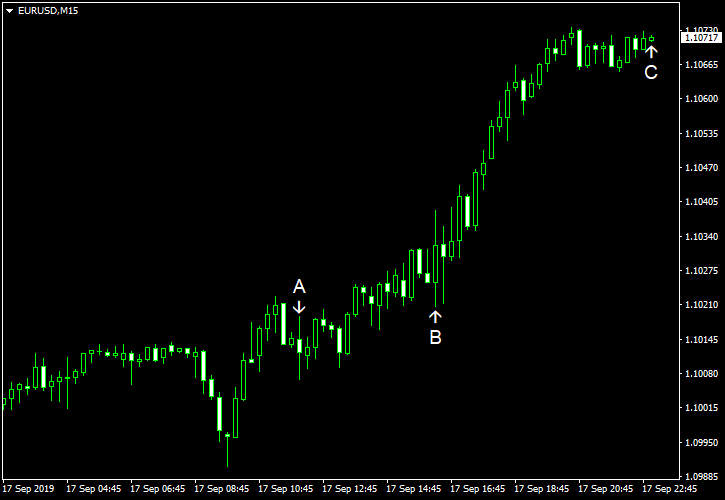

September 172019

EUR/USD Rallies on German Business Sentiment

EUR/USD jumped today after the business sentiment for Germany as well as the whole eurozone showed a surprisingly sharp improvement this month. (Event A on the chart.) But market participants question the ability of the currency pair to maintain its upward momentum for long, especially if the Federal Reserve will disappoint markets with its monetary policy announcement tomorrow. Both industrial production and capacity utilization increased in August. Industrial production rose by 0.6%, exceeding […]

Read more