- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: February 19, 2010

February 19

February 192010

Polish Zloty Down on European Confidence Decline

The Polish currency fell versus most of the main currencies from outside the European Union as the emerging budget problems in the region and an economic slow down among its trading partners decreased appetite for assets in the country. After ZEW economic reports showed a decrease in investor confidence in Poland and most of the Eastern European EU members, the zloty decreased versus high-yielding currencies around the world and a more attractive U.S. dollar, since the economic recovery in North […]

Read more February 19

February 192010

Loonie Up Despite U.S. Discount Rate

The Canadian dollar pared all of its yesterday’s losses versus the U.S. and headed for another weekly increase versus the greenback and most of the main traded currencies as demand for the countries raw materials increased globally. The loonie manage to gain versus the U.S. dollar today despite renewed appetite for assets in the U.S. after the Federal Reserve raised its discount rate, signaling that the economic strength in the country is allowing central bankers to lift stimulus. […]

Read more February 19

February 192010

Pounds Meets Abyss on Fiscal Concerns, U.S. Discount Rate

The pound touched the lowest level in 2010 versus the greenback and declined versus most of the 16 main traded currencies as economic stimulus are likely to be maintained in the U.K., considering the slow pace of the nation’s economic growth and raising gap in the public accounts. The U.K. currency reached the lowest price in 9 months versus the U.S. dollar after the Federal Reserve rose its discount rate for the first time in three years, suggesting that the economic […]

Read more February 19

February 192010

Another Euro Weekly Decline on EU’s Fiscal Crisis

The euro continued to decline for another week versus important currencies around the world as the some of the Eurozone member countries’ budget deficit is shunning investors from the region, considering the economic outlook in other parts of the world is significantly more attractive to investors. The European single currency touched the lowest levels in 2010 versus important currencies like the U.S. dollar, the Brazilian real and other higher-yielding options in foreign-exchange markets as the Eurozone countries known […]

Read more February 19

February 192010

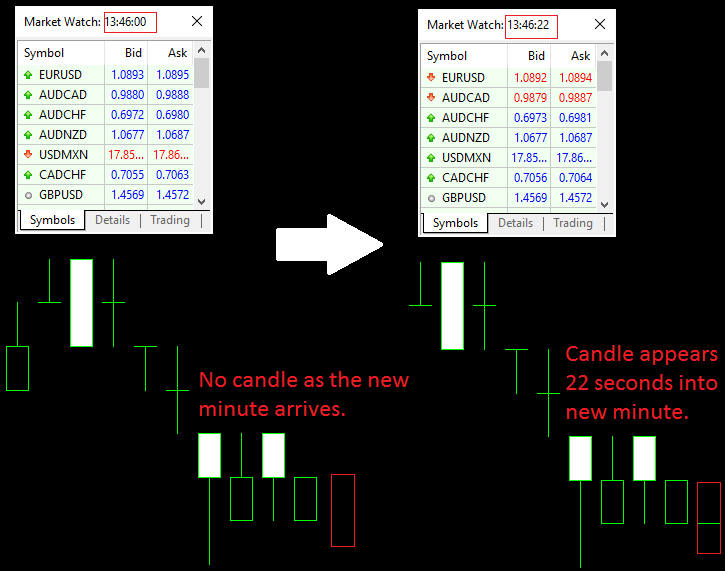

“New Candle” Problem in MetaTrader

MetaTrader is a great software for charting, analyzing, trading, and testing. It has many useful features and supports many tools that make the life of the Forex trader much easier. But when it comes to drawing the new candles/bars on the chart there is a tricky part of MetaTrader. Both in MT4 and MT5, the candles are drawn depending on the ticks (each tick is a moment when a new quote from the broker comes) rather […]

Read more February 19

February 192010

NZ Dollar Down on Trading Partners Hawkish Tone

The New Zealand dollar started this Friday losing versus currencies from its main trading partners as central bankers from Australia and the U.S. are adopting a hawkish tone leaving the New Zealand dollar less attractive as rate hikes are not forecast in the short term for the kiwi nation. After the Federal Reserve raised its discount rate for the first time in three years in the U.S. and central bankers in Australia stated that […]

Read more February 19

February 192010

Canadian Dollar Down on U.S. Discount Rate

After touching the highest rate in February on renewed risk appetite, the Canadian dollar retreated versus its U.S. counterpart after the Federal Reserve raised its discount rate for the first time in three years, allowing the greenback to be more attractive than the loonie in forex markets. The Canadian dollar ended a winning streak against the dollar and erased most of this week’s gains versus the U.S. currency after the Federal Reserve discount rate […]

Read more February 19

February 192010

Discount Rate Surprise Fuels Dollar Rally

The dollar touched the highest level in 2010 versus several important currencies this Thursday as the Federal Reserve raised its bank discount rate for loans, spurring demand for assets in the country as the economy seems to be picking up, allowing the nation’s central bank to lift stimulus. All of the 16 main traded currencies dropped versus the greenback after the Federal Reserve announced a discount rate hike for direct bank loans, being that the first […]

Read more