The US dollar versus the Japanese yen currency pair seems to be under constant bearish pressure. Is this really so?

Long-term perspective

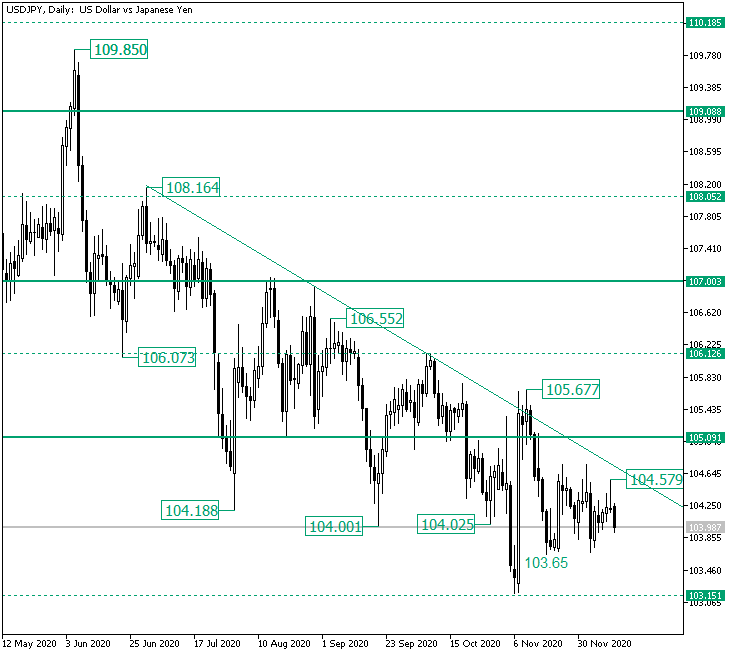

Following the 109.08 level false piercing, as the high of 109.85 highlights, the pair entered into a descending trend limited by the trendline that starts from 108.16.

Like so, the trend extended until a hair away from the intermediary level of 103.15. From there, a convinced appreciation came into being. However, even if very determined, it stopped at the double resistance area defined by the 105.09 level and the falling trendline.

As a result, a sharp decline ensued. Interestingly, it stopped at 103.65, thus printing a higher low. Content, the bulls attempted to push the price back towards the resistance area. Yet, their efforts proved futile, as the first two did not make it to the trendline, and the third one, at 104.57, became a lower high.

So, as long as the bulls are not able to validate 105.09 as support, which would open the door to the 106.12 intermediary level, the bears remain behind the wheel, driving the price toward the 103.15 stop.

Short-term perspective

The fall from 105.67 bottomed at 103.65, just above the firm support area of 103.71. From there, two appreciation attempts were made, but both crafted only false piercings, peaking at 104.76 and 104.75, respectively, and unfolding declines to the 103.83 and 103.67 lows, respectively.

As of writing, the third bullish attempt crafted the 104.57 high before returning beneath 104.44. Taking these matters into consideration, it can be said that the market ranges between 104.44 as resistance and 103.71 as support.

Until very recently, the current phase was an appreciation, supported by the ascending trendline that sprang from the 103.67 low. If the bulls do manage to get and keep the price above this line and then reinforce 104.44 as support, then they may have a chance for 105.27.

However, as the trendline ceded or, in the case of a rally, if 104.44 keeps its role as resistance, then the 103.71 level is the next bearish objective.

Levels to keep an eye on:

D1: 105.09 106.12 103.15

H4: 104.44 103.71 105.27

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.