- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: January 27, 2011

January 27

January 272011

Dollar Drops vs. Euro as Fed Maintains Stimulus Measures

The US dollar slipped today versus the euro after the US Federal Reserve maintained its quantitative easing program, signaling that the US economy hasn’t quite recovered yet and still requires stimulus. Some economists had hopes that the Fed would raise the interest rates as the economy of the US looked for them healthy enough to survive without unprecedented stimulus measures. Such hopes hadn’t come to pass as the Federal Open Market […]

Read more January 27

January 272011

Yen Slumps After S&P Downgrades Japan’s Rating

The Japanese yen tumbled today after the Standard and Poor’s downgraded Japan’s credit rating one step to AA- as the Japanese government hasn’t done enough to reduce the nation’s enormous debt. S&P said in its statement: The downgrade reflects our appraisal that Japanâs government debt ratios â already among the highest for rated sovereigns â will continue to rise further than we envisaged before the global economic recession hit […]

Read more January 27

January 272011

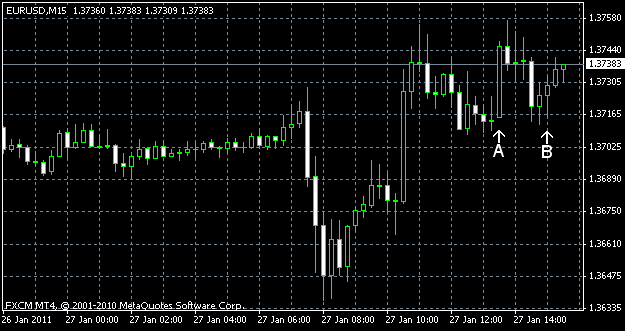

EUR/USD Rises for Another Day as US Economy Underperforms

EUR/USD continues to rise as the US economy underperforms, while the outlook for the European economy improves. Durable goods orders and initial jobless claims showed far worse results than was expected, while news from the house market were good. The currency pair slumped at the beginning of this trading session, but quickly recovered. EUR/USD trades now at about 1.3745 after it dropped previously to 1.3637. Initial jobless claims increased […]

Read more