- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: February 1, 2011

February 1

February 12011

Brazilian Real Goes Up with Rising Inflation

The Brazilian real edged up today as the index of consumer prices rose more than the analysts expected, increasing probability of an interest rate hike by the central bank. The IPC-S index (the weekly index of consumer prices) of the Getulio Vargas Foundation rose 1.27 percent as of January 31, 2011, while the analysts at Bloomberg predicted an increase by 1.22 percent. The last week’s change rate was the biggest in about a year. USD/BRL slipped from 1.6680 to 1.6660 […]

Read more February 1

February 12011

Aussie Reaches Parity with Greenback as RBA Holds Interest Rates

The Australian dollar climbed to parity with its US counterpart today as the global economy recovers, commodity prices advance and private investment in the nation increases, reducing the incentives for an interest rates cut. The Reserve Bank of Australia kept its cash rate at 4.75 percent, continuing to attract speculators interested in so-called carry trades. The Bank’s Governor Glenn Stevens indicated that the global production strongly grew last year and said that the inflation […]

Read more February 1

February 12011

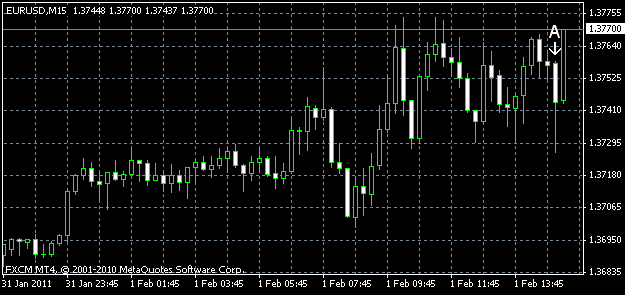

Investors Prefer Risk, Keeping EUR/USD Going Higher

EUR/USD continues its rally as investors still favor riskier assets despite troubles in Egypt. The dollar attempt to advance after the report showed that US manufacturing continues to expand, but the rise was short-lived partly, perhaps, as construction spending dropped significantly instead of rising, as was predicted. EUR/USD trades near 1.3763. ISM PMI rose to 60.8% in January as an rconomic activity in the manufacturing sector expanded in January for the 18th consecutive month. […]

Read more February 1

February 12011

Pound Rallies on Anticipation of Interest Rates Hike

The Great Pound posted an impressive advance for the second day today as more and more policy makers are starting talking about necessity of the interest rates increase to suppress the accelerating inflation. Martin Weale, the policy maker at the Bank of England, said that there is a “powerful case” for a “modest rise” in the interest rates. The inflation in the UK accelerated to 3.7 percent in December, significantly exceeding the central bank’s target of 2 percent. The central bank’s Governor […]

Read more