- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: February 3, 2011

February 3

February 32011

Dollar Gains as Service Industries Expand

The US dollar gained today, reversing its downward trend that was in place for past several days, after the set of the good economic data from the US was released, including the report about the service industries. The economic activity in the non-manufacturing sector grew in January for the 14th consecutive month, causing Non-Manufacturing ISM index to climb from 57.1 to 59.4, while a gain to only 57.2 was expected by the specialists. The factory orders increased […]

Read more February 3

February 32011

Euro Slumps as ECB Holds Interest Rates Unchanged

The euro tumbled today as the European Central Bank left the interest rates unchanged and the comments of bank’s President Jean-Claude Trichet caused the speculation that the rates will remain unchanged for the whole year. The Governing Council of the ECB decided at todayâs meeting that the interest rate on the main refinancing operations will remain unchanged at 1 percent. Such decision was generally expected by market participants. Trichet said in the introductory statement to the ECB press conference […]

Read more February 3

February 32011

Rising Services PMI Pushes Pound Further Up

The Great Britain pound rose today for a fourth day as the growth of the UK service industries in January was better than the economists predicted, reinforcing the outlook for a interest rates hike by Britain’s central bank. The Markit/CIPS Business Activity Index rebounded sharply in January, rising from 49.7 to 54.5, the highest level since May 2010. The expected value was 51.2. The report explained the good growth by “improved weather and return to business as normal”. GBP/USD […]

Read more February 3

February 32011

Australian Dollar Rises with Mortgage Approvals & Trade Surplus

The Australian dollar went up today as the number of mortgage approvals surged and the trade surplus expanded more than predicted. The number of mortgage approvals jumped 8.7 percent in December. This growth looks astonishing compared to the expected value of 1.6 percent and considering the decline by 3.9 percent in November. The trade balance posted a surplus of 1.98 billion in December, while the median forecast was 1.63 billion. AUD/USD rose from 1.0101 to 1.0126 as of 12:19 […]

Read more February 3

February 32011

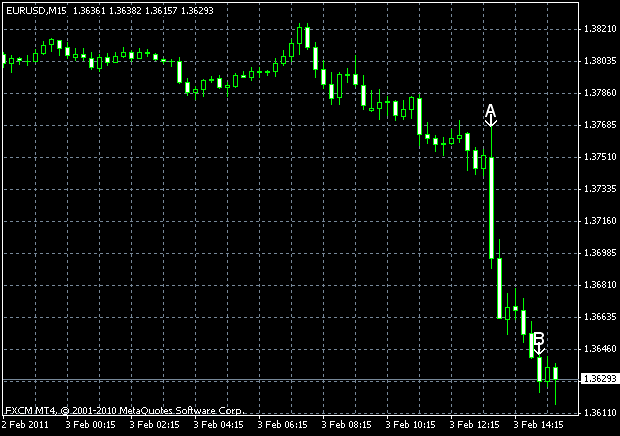

EUR/USD Tumbles on Trichet’s Comments & Good US Reports

President of the European Central Bank Jean-Claude Trichet said that inflation risks are “broadly balanced”, reducing bets that ECB will raise interest rates and driving EUR/USD down. At the same time, US service industries and factory orders posted surprisingly good results, supporting speculations that the Federal Reserve may decide to increase interest rates in the US. EUR/USD trades now at 1.3632, while it opened at 1.3809. Initial […]

Read more February 3

February 32011

Ruble Gains as Brent Oil Trades Above $100

The Russian ruble strengthened after Brent crude oil rallied above $100, attracting investors to the assets of the biggest world energy exporter. Brent oil rallied 0.6 percent to $102.36 per barrel. Brent has risen 8 percent this year, allowing the ruble to appreciate 1.8 percent. Oil and natural gas makes up about a quarter of Russiaâs economic output. The analysts say that the ruble has potential to rise further. […]

Read more February 3

February 32011

Loonie Gains as Crude Oil Climbs to Two-Year High

The Canadian dollar rose today as the prices for crude oil rallied to the highest level in two years and as the global economic recovery increased attractiveness of the currencies linked to growth. The price for crude oil, the main export of Canada, climbed as much as 1.1 percent to $91.78 a barrel. The loonie, as the Canadian currency is nickname, also is benefiting from the signs of the global economic growth. The employment increase in the US was considerably better than was predicted, posting […]

Read more