- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: February 25, 2011

February 25

February 252011

Sterling Declines as UK Economy Shrinks

The Great Britain pound extended its losses today after the report showed that Britain’s economy shrank more than predicted in the fourth quarter of the last year. Britain’s gross domestic product contracted by 0.6 percent in the fourth quarter of 2010, revised down from the previously estimated fall of 0.5 percent. Chris Huddleston, a trader at Investec Bank Plc, said that the decline was caused by the profit-taking by traders and didn’t affect the expectations […]

Read more February 25

February 252011

Japanese Yen Regains Strength After Declining

The Japanese yen rebounded today after it weakened on the speculation that the tensions in Libya has eased and that the Japanese currency is overbought. Specialists say that the unrest in North Africa and Middle East isn’t severe enough to derail the global economic recovery. OPEC promised to increase supply of oil in case if the tensions will disrupt production. Still, uncertainty in the markets persists, driving investors to safer assets. USD/JPY fell from […]

Read more February 25

February 252011

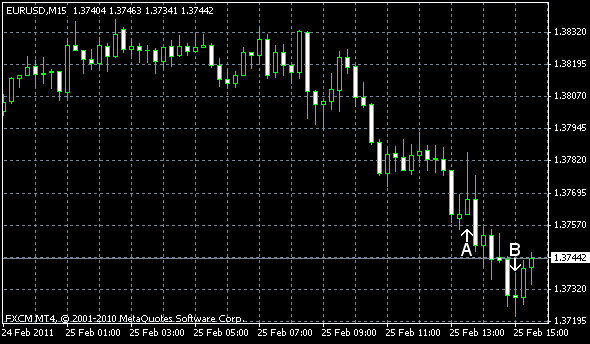

EUR/USD Drops as US Economy Improves

EUR/USD dropped today as the reports showed that the US economy improved. The growth of GDP and the improvement of the confidence in the jobs market supported the dollar. On the other hand, the hawkish stance of the European Central Bank may boost the euro. EUR/USD trades currently near 1.3746. US GDP increased at an annual rate of 2.8% in the fourth quarter of 2010, according to the “second” (preliminary) estimate, while forecasts suggested a 3.3% growth. In the advance estimate, the increase of GDP was […]

Read more February 25

February 252011

Pound Slumps as Sales & Consumer Confidence Decline

The Great Britain pound tumbled as the reports showed that the UK economic recovery stalled and the political unrest in the countries of North Africa and Middle East drove traders away from riskier assets. The CBIâs Distributive Trades survey showed that 36 percent of retailers saw the volume of sales rise in the two weeks to February 16, while 30 percent said they fell compared with a year ago, resulting in the balance of +6 percent. […]

Read more February 25

February 252011

Loonie Rises as Libyan Uprising Spur Oil Prices to 29-Month High

The Canadian dollar strengthened as the unrest in Libya caused the prices for crude oil to jump to the highest level in 29 months, increasing attractiveness of the currencies related to economic growth. The tensions in North Africa and Middle East have two-sided effect on the Canadian currency. On one side, they caused the market sentiment to shift towards risk aversion, which is negative for the loonie. On the other side, they caused the rally of some commodities, especially crude oil â […]

Read more