- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: March 2, 2011

March 2

March 22011

Ruble Gains as Russia Loosening Control, Combats Inflation

The Russian ruble advanced today, rising to the highest level in more than a year against the US dollar, as the government loosened control of the currency and the central bank attempts to deal with the inflation. Nikolay Podguzov, VTB Capitalâs head of fixed- income strategy in Moscow, said: The decision to widen the band proves the Russian central bankâs willingness to address the inflation problem as a first priority. The central bank is ready to accept further exchange rate volatility. […]

Read more March 2

March 22011

Rand Goes Up as Gold Rallies

The South African rand jumped today, erasing yesterday’s losses, as gold surged on the concerns about the inflation and the unrest in Libya. The risk appetite waned from markets as the infightings between the forces loyal to Libya’s leader Muammar al-Gaddafi and the rebels renewed, increasing demand for safer assets. Gold climbed 0.2 percent to $1,436.90 per ounce, rising for the fourth day. The precious metal together with platinum makes up about a fifth of South Africaâs […]

Read more March 2

March 22011

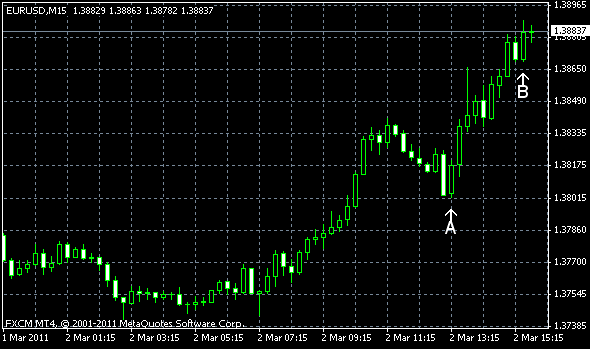

EUR/USD Rises, Can Good US Jobs Market Stop Rally?

EUR/USD rallied today almost without pause despite risk aversion sentiment of traders that was caused by renewed concerns about uprising in Libya. The positive news from the US labor market may stop the rally, though. EUR/USD trades now at about 1.3882. ADP employment increased by 217k from January to February on a seasonally adjusted basis. The estimated change of employment from December to January was revised up to 189k from […]

Read more March 2

March 22011

Pound Erases Yesterday’s Gains

The Great Britain pound declined today after it jumped yesterday as unexpected rise of the house prices and the record manufacturing PMI lead to the speculation the central bank will increase the interest rates. The Nationwide Building Society House Price Index increased by 0.3 percent in February from January. The index fell by 0.1 percent in January and was expected to decline even more â by 0.2 percent. The seasonally adjusted Markit/CIPS UK Manufacturing PMI […]

Read more March 2

March 22011

Kiwi Falls as Prime Minister Speaks About Interest Rates Reduction

The New Zealand dollar weakened after Prime Minister John Key said that the interest rates should be reduced. The currency also fell as the tensions in Libya intensified. Investors, interested in so-called carry trades, are drawn to New Zealand because of its relatively high interest rates. Therefore reduction of the rates would decrease attractiveness of the New Zealand dollar, or the kiwi as it’s often called. Currently the official cash rate stands […]

Read more