EUR/USD dropped today after Moodyâs Investors Service cut Portugalâs credit rating from A1 today to A3 today. Today’s report about the housing starts and building permits confirmed a depressed state of the US housing sector. EUR/USD currently trades near 1.3946.

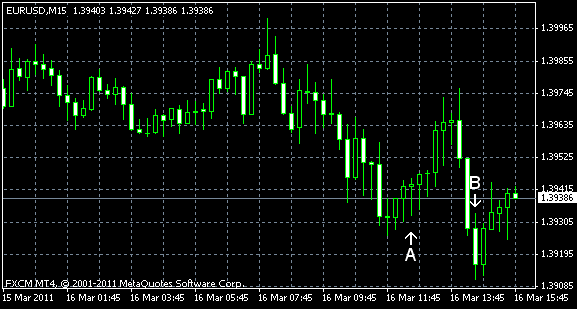

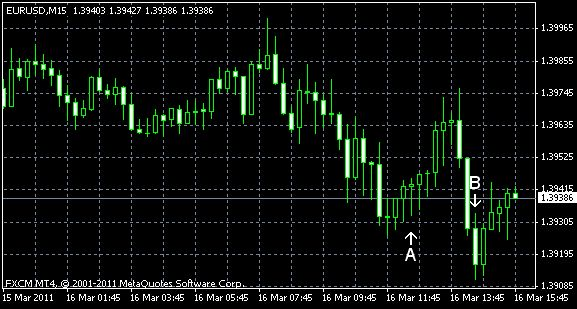

US housing starts and building permits in February were below the January levels. Building permits were at a seasonally adjusted annual rate of 517k, compared to the revised January rate of 563 and the forecast of 580k. Housing starts were at a seasonally adjusted annual rate of 479k, compared to the revised January estimate of 618k and the expected value of 580k. (Event A on the chart.)

PPI increased 1.6% in February, seasonally adjusted, following the advances by 0.8% in January. The median forecast predicted a slower growth by 0.7%. (Event A on the chart.)

US current account deficit decreased to $113.3 billion (preliminary) in the fourth quarter of 2010 from $125.5 billion (revised) in the third quarter. Forecast were close to the actual reading, suggesting a $111 billion deficit. The smaller deficit was the result of the decrease of the deficit on goods, as well as the increase in the surplus on services. (Event A on the chart.)

Crude oil inventories increased by 1.7 million barrels from the previous week. Total motor gasoline inventories decreased by 4.2 million barrels last week. Both are above the upper limit of the average range for this time of year. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please, reply using the form below.