- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: May 26, 2011

May 26

May 262011

New Zealand Dollar Jumps on Chinese Investments

The New Zealand dollar surged today on the speculation that Chinese companies are interested in buying the New Zealand assets. Interest.co.nz said that China Investment Corporation, a sovereign wealth fund, is planning to invest in the South Pacific nationâs assets, including government bonds, companies and dairy farms. According to the website, the company may set aside 1.5 percent (equivalent of about NZ$6 billion) of its foreign exchange reserves for investments in the New […]

Read more May 26

May 262011

Australian Dollar Rises with Private Capital Expenditure

The Australian dollar erased losses versus the US counterpart today as the government report showed that the value of new capital expenditures made by private businesses increased in the first quarter of this year. The seasonally adjusted estimate for total new capital expenditure rose 3.4 percent in the first three months of 2011, following the increase by 1.5 percent it the previous quarter. The forecast value was 2.8 percent. The positive data caused investors to increase […]

Read more May 26

May 262011

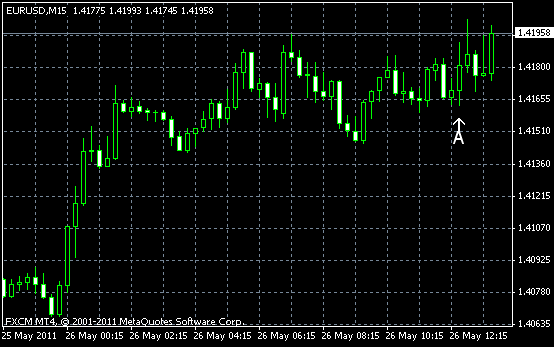

US Economic Growth Below Forecasts, EUR/USD Goes Higher

EUR/USD advanced today as the US economy expanded less than anticipated in the first quarter of this year and jobless claims unexpectedly increased. The currency pair jumped at the opening of the trading session and held its gains, slowly advancing on the negative US reports. EUR/USD trades currently at 1.4200. US GDP grew 1.8% in the first quarter of 2011, according to the preliminary estimate, following the 3.1% growth in the fourth quarter of 2010. The reading was the same as in the previous […]

Read more May 26

May 262011

Euro Goes Higher as China Plans Purchase of European Bonds

The euro advanced today on the speculation that Asian countries will buy European bonds despite the debt crisis that still threatens stability of Europe’s economy. According to Financial Times, Klaus Regling, Chief Executive Officer of the European Financial Stability Facility, said that investors from China and other Asian countries are planning to buy Portuguese bailout bonds after the EFSF will start selling them in June. The euro also […]

Read more