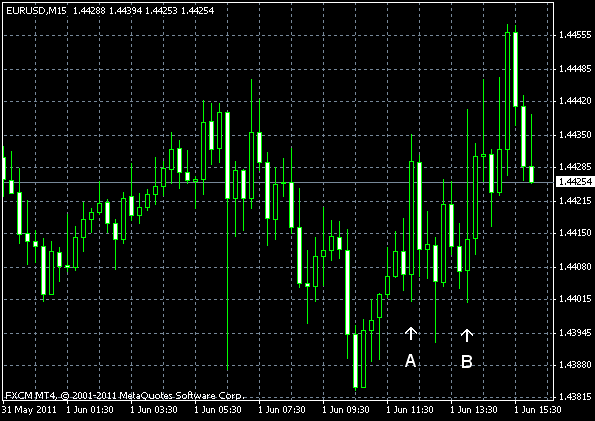

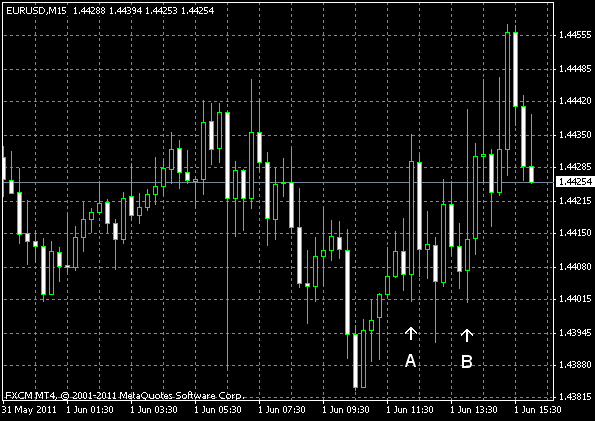

EUR/USD extended its advance today as the US economy continues to show one bad result after another. The PMI was below even pessimistic forecast, while employment change was terribly low. After such a bad report about employment it’ll be interesting to see what the

ADP employment showed an increase by 38k in May from April. The reading is just disastrous compared to forecasts that promised the same increase as in April â 177k (revised from 179k). (Event A on the chart.)

ISM PMI was at 53.5% in May, down from 60.4% in April. Analysts hoped for a reading of 58.1%. The index posted the lowest value since December 2009. (Event B on the chart.)

Construction spending rose 0.4% in April on

If you have any comments on the recent EUR/USD action, please, reply using the form below.