- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: June 8, 2011

June 8

June 82011

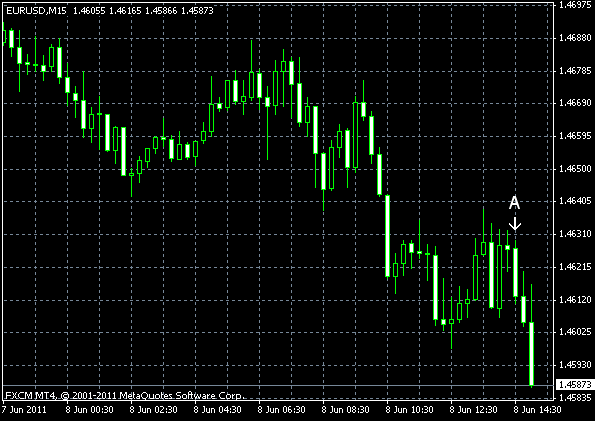

EUR/USD Down on Renewed Worries about Europe

EUR/USD fell today on fears that the debt crisis in Europe may worsen. Yesterday the currency pair rose as Federal Reserve Chairman Ben S. Bernanke signaled that the Fed is going to maintain its quantitative easing program “as US economic growth so far this year looks to have been somewhat slower than expected”. EUR/USD trades at 1.4585 now. Crude oil inventories decreased by 4.8 million barrels […]

Read more June 8

June 82011

Yen Profits from Fears of European Crisis

The Japanese yen rose today as the concern that the sovereign-debt crisis in Europe will worsen bolstered attractiveness of Japan’s currency as a safe haven. The International Monetary Fund lent â¬26 billion euro, but said that the loan “entails important risks”. Germany’s Finance Minister Wolfgang Schaeuble stated that bondholders have to contribute a “substantial” portion of a second bailout package for Greece. The MSCI World Index retreated 0.2 percent. USD/JPY went […]

Read more June 8

June 82011

Pound Goes Lower on Shop-Price Inflation & Retail Sales

The Great Britain pound weakened today after the report showed that the growth of the UK shop prices slowed and retail sales decreased in May. British Retail Consortium reported that the retail sales posted an annual decline by 2.1 percent in May, following the growth by 5.2 percent in April. The shop-price inflation decreased to 2.3 percent in May from 2.5 percent in April. Stephen Robertson, Director General, British Retail Consortium, explained the sharp […]

Read more June 8

June 82011

Australian Dollar Falls on Concerns for Economic Growth

The Australian dollar dropped today on the mounting concerns about the slowdown of the global economic recovery, caused by the debt crisis in European and the unfavorable economic data from the US. The International Monetary Fund said that its aid program for Portugal “entails important risks”. The IMF also said that “important challenges remain to overcome sovereign debt problems in the euro area”. These words reduced optimism for the Eurozone economic stability, even though the IMF […]

Read more June 8

June 82011

US Dollar Weakens on Bernanke Speech

The US dollar weakened after Federal Reserve Chairman Ben S. Bernanke suggested that the Fed should maintain stimulus as “US economic growth so far this year looks to have been somewhat slower than expected”. Such dovish statement wasn’t surprise for Forex traders after the terrible economic reports last week. Still, the speech was negative for the dollar as it reduced probability that the Fed will lift […]

Read more