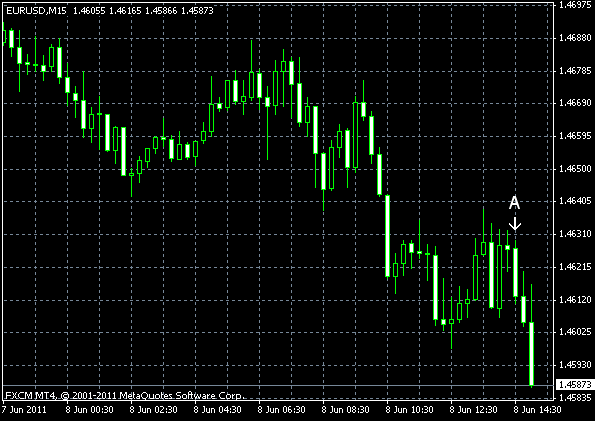

EUR/USD fell today on fears that the debt crisis in Europe may worsen. Yesterday the currency pair rose as Federal Reserve Chairman Ben S. Bernanke signaled that the Fed is going to maintain its quantitative easing program “as US economic growth so far this year looks to have been somewhat slower than expected”. EUR/USD trades at 1.4585 now.

Crude oil inventories decreased by 4.8 million barrels from the previous week, while total motor gasoline inventories increased by 2.2 million barrels last week. Both are in the upper limit of the average range. (Event A on the chart.)

Yesterday, a report on consumer credit was released, showing an increase by $6.3 billion in April from March, following the advance by $4.8 billion (revised down from $6.0 billion) from February to March. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please, reply using the form below.