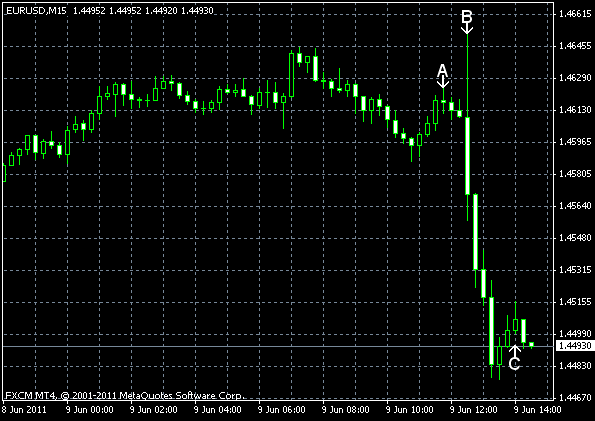

EUR/USD extended its losses today as the European Central Bank left its benchmark minimum bid rate unchanged at 1.25% (Event A on the chart.). Such decision was expected by economists, but concerns that the Bank will avoid increasing of interest rates because of fiscal problems of the Eurozone hurt the currency pair anyway.

The US trade balance posted a deficit of $43.7 billion in April, down from $46.8 billion in March. Forex market participants were expecting the deficit to widen to $48.6 billion. (Event B on the chart.)

Initial jobless claims was at 427k in the week ending June 4, a small increase from the previous week’s figure of 426k. The predicted value was 424k. (Event B on the chart.)

Wholesale inventories grew 0.8% in April, compared to the market expectations of a 1.0% growth. The March reading was revised to 1.3% from 1.1%. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please, reply using the form below.