- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: June 14, 2011

June 14

June 142011

Improving Economy Pushes Dollar Down

The US dollar fell today against higher-yielding currencies, but rose against riskier ones, as the macroeconomic data improved outlook for growth of the US economy. The US data combined with the reports from China sapped attractiveness of safer currencies to Forex traders. The Producer Price Index rose 0.2 percent in May after rising 0.8 percent in April. The expected growth was 0.1 percent. The retail sales fell 0.2 percent last […]

Read more June 14

June 142011

China’s Economy Benefits Australia’s Dollar

The Australian dollar gained today after the government reports showed that China’s economic growth accelerated and stocks jumped, increasing appeal of higher-yielding currencies. The MSCI Asia Pacific Index of shares rose 1.1 percent after falling 0.2 percent. The Stoxx Europe 600 index advanced 0.8 percent. The gains can be limited after China National Radio said today that the nation may boost borrowing costs this […]

Read more June 14

June 142011

Growing China’s Economy Saps Demand for Safety of Yen

The Japanese yen together with other safe currencies, including the US dollar and the Swiss franc, weakened against most major currencies today as the robust growth of China’s economy reduced investors’ demand for safety. China’s consumer prices inflation accelerated to 5.5 percent from 5.3 percent last month according to the National Bureau of Statistics. The industrial production grew 13.3 percent in May, following the 13.4 percent growth in the month before. The Producer […]

Read more June 14

June 142011

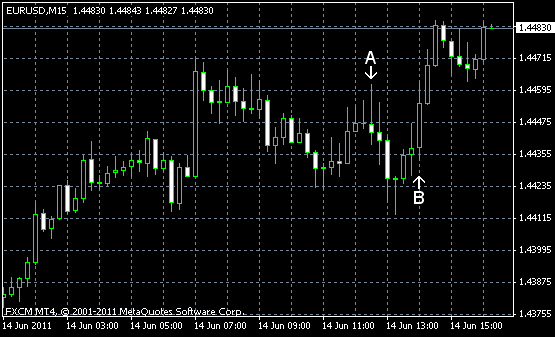

EUR/USD Moves Higher as China Reduces Demand for Safety

EUR/USD rose today as the positive economic data from China reduced demand for the dollar as a safe haven. The euro declined versus the dollar somewhat as the US economic reports were better than expected, but remained strong. EUR/USD trades now at 1.4479. PPI rose 0.2% in May (seasonally adjusted) following the increase by 0.8% in April. The actual value reading was somewhat higher that the forecast 0.1% increase. (Event A on the chart.) Retail […]

Read more