- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: June 15, 2011

June 15

June 152011

Swiss Franc Rallies vs. Euro on Protests in Greece

The Swiss franc rallied against the euro as people in Greece are protesting against the austerity measures and Greece’s Prime Minister George Papandreou may resign. The currency slipped versus the US dollar and the Japanese yen. As much as 20,000 protesters in Greece went on demonstrations against the planned wage cuts and tax increases. The police forces fired teargas at the protesters. Papandreou offered to resign to allow the formation of a unity government if all opposition parties would […]

Read more June 15

June 152011

Pound Slides on Rising Jobless Claims & Slowing Wage Growth

The Great Britain pound tumbled today as the government reports showed that the number of unemployment claims unexpectedly increased and the wage growth slowed. The number of people seeking unemployment benefits rose to 19,600 in May from 16,900 in April, according to the report of National Statistics. The unemployment rate stayed at 7.7 percent. The average earnings growth slowed to 1.8 percent in April from 2.4 percent in March. GBP/USD slid to 1.6272 from 1.6369 today as of 11:36 […]

Read more June 15

June 152011

Debt Crisis Eats Away Euro’s Strength

The euro slumped today, erasing this week’s gains against the US dollar, on concerns that the European Union leaders won’t be able to reach agreement about measures necessary to battle the debt crisis. German Chancellor Angela Merkel and French President Nicolas Sarkozy will meet on June 17 in Berlin as the pressure to resolve their disagreement strengthens. Standard & Poor’s lowered its long-term sovereign credit ratings on Greece to ‘CCC’ […]

Read more June 15

June 152011

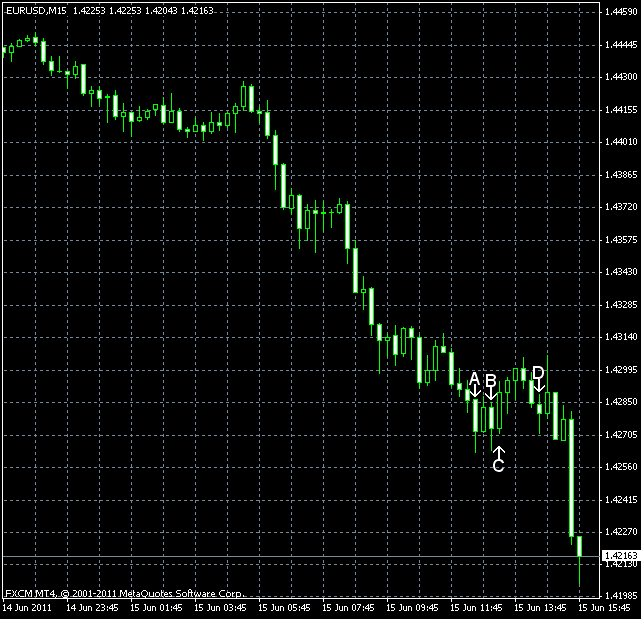

EUR/USD Tumbles as Europe’s Crisis Worsens

EUR/USD slumped today, erasing all gains of this week, as the European leaders can’t find an agreement about measures to deal with the sovereign-debt crisis. Greece’s credit rating was downgraded to the lowest possible ‘CCC’ on June 13. The fears of the possible default drove the euro to the downside even as the US economic data was very poor today. EUR/USD trades at 1.4218 now, falling from 1.4438. CPI increased 0.2% in May on a seasonally […]

Read more June 15

June 152011

Pound Weakened by Slowing Inflation

The Great Britain pound weakened today as the reports showed that the core inflation slowed and the retail price index remained unchanged last month. The consumer price index remained at 4.5 percent in May (year-on-year) as was expected. Yet the core inflation decreased to 3.3 percent from 3.7 percent, while only a small drop to 3.6 percent was expected. The retail price index surprised traders unpleasantly, remaining at 5.2 percent despite […]

Read more