- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: June 23, 2011

June 23

June 232011

Pound Falls as Retail Sales Decline

The Great Britain pound dropped today for the second day as the retail sales retreated to the lowest level this year, supporting the outlook that the Bank of England maintain stimulus. The CBIâs Distributive Trades Survey posted the balance of -2 percent, the first negative value in a year. The expected reading was 11 percent. Reading above zero indicates growth of sales, below zero signals about decline. Together with yesterday’s BoE minutes the report […]

Read more June 23

June 232011

Rand Weakens with Commodities on US Growth Forecast

The South African rand fell today for the second day as commodities weakened after the Federal Reserve slashed its US growth forecast. The Standard & Poorâs GSCI Index of raw materials fell for the first day in three and gold and platinum, which makes up 20 percent of the South African exports, dropped. The FTSE/JSE Africa All Share Index, the nationâs benchmark stock index, went down 0.8 percent. The Fed estimated this […]

Read more June 23

June 232011

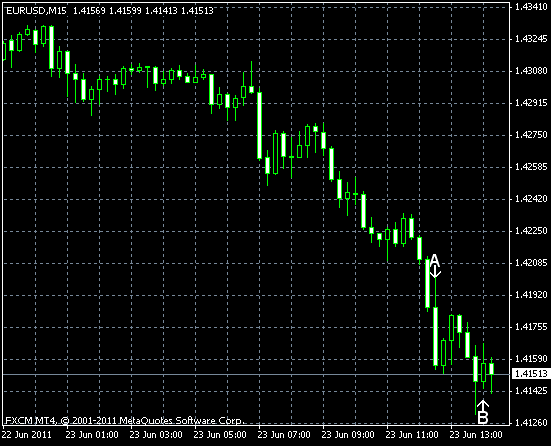

EUR/USD Down Even as Jobless Claims Rise & Home Sales Fall

EUR/USD slumped today on the speculation that the Federal Reserve won’t extend its bond purchases after the current program of asset buying will come to an end this month. Some economists even think that the Fed won’t continue the quantitative easing, but that sounds unlikely, considering current unfavorable economic conditions in the US. Today’s reports were somewhat positive for the housing market, but negative for the labor market. Tomorrow we’ll […]

Read more June 23

June 232011

Canada’s Dollar Fluctuates After Carney Statement

The Canadian dollar fluctuated after the dovish statement of the Federal Reserve and the speech of Mark Carney, Bank of Canada Governor. The speech of the Governor left mixed feelings, while the Fed statement was moderately negative for the currency. Crude oil, the biggest export of Canada, dropped $1.11 to $94.30 per barrel on NYMEX after the Fed released its statement. Earlier, crude gained by $1.24 to $95.41 as the US stockpiles declined. Carney was quite pessimistic about […]

Read more