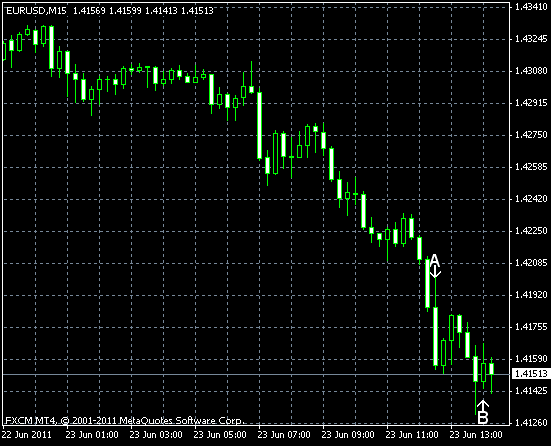

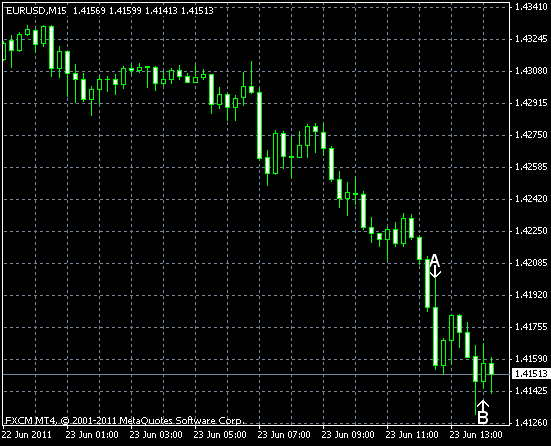

EUR/USD slumped today on the speculation that the Federal Reserve won’t extend its bond purchases after the current program of asset buying will come to an end this month. Some economists even think that the Fed won’t continue the quantitative easing, but that sounds unlikely, considering current unfavorable economic conditions in the US. Today’s reports were somewhat positive for the housing market, but negative for the labor market. Tomorrow we’ll see a very important final estimate of the US GDP in the first quarter of this year. EUR/USD trades at 1.4145, falling from 1.4355.

Initial jobless claims rose to 429k last week from the previous week’s upwardly revised reading of 420k. Forecast suggested a reading of 414k. (Event A on the chart.)

New home sales was at 319k in May, below the revised April reading of 326k, but above the forecast value of 311k. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please, reply using the form below.