- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: June 28, 2011

June 28

June 282011

Franc Posts New Record vs. Dollar on Private Consumption

The Swiss franc jumped today, reaching new all-time record against the US dollar, as the Swiss consumer demand improved last month. The optimism for Greece allowed the euro to outperform the Swiss currency, though. The UBS consumption indicator advanced by 0.34 points to 1.91 in May, the highest level since August 2010. The main contributor to the increase was the new car registrations. The retail sales were also responsible for the rise of the consumer demand. The report said […]

Read more June 28

June 282011

Hopes for Greece Bolster Malaysia’s Ringgit

The Asian currencies, including the Malaysian ringgit, rallied today on hopes that debtors will extend maturities of the nation’s debt and the Greek austerity vote will pass. Greece’s Prime Minister George Papandreou urged the nation’s policy makers yesterday to listen to their “patriotic conscience” and support the additional tightening measures. If the politicians won’t agree on the austerity the Eurozone may face its first default in history. But market participants remain hopeful […]

Read more June 28

June 282011

Sterling Trades Lower with Widening Current Account Deficit

The Great Britain pound dropped today as the signs of the UK economic slowdown led to the speculation that the nation’s central bank will be forced to maintain stimulus. The UK current account posted the deficit of £9.4 billion in the first quarter of 2011, down from the revised deficit of £13.0 billion in the previous quarter. The gross domestic product grew by 0.5 percent in the Q1 2011, in line with the previous estimates. The business investment in the first three months […]

Read more June 28

June 282011

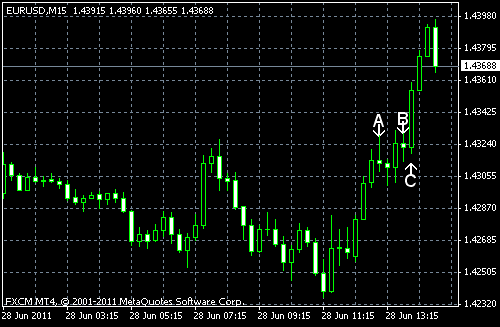

Second Day of Gains of EUR/USD as Traders Hope for Better

EUR/USD jumped today for the second day as hopes for Greece supported the euro. The currency pair traded sideways in the first half of today’s trading session, but surged at the second half. The positive influence of the stabilizing manufacturing on the dollar was tempered by the negative impact of the declining consumer sentiment. EUR/USD trades now at 1.4361. S&P/Case-Shiller home price index dropped from 141.05 in March to 140.93 in April. On year-on-year basis, the change in April was -3.9%, matching […]

Read more June 28

June 282011

Canadian Dollar Rebounds vs. Greenback on Stocks & Oil

The Canadian dollar gained versus the US dollar today, after reaching yesterday the lowest level in more than three months, as crude oil slowed its decline and stock advanced. Futures for delivery of crude oil in August slumped as much as 1.7 percent to $89.61 per barrel in New York, before rebounding to $90.81 a barrel, resulting in the 0.4 percent loss. The Standard & Poorâs 500 Index gained 0.9 percent, the first advance […]

Read more