EUR/USD snapped its gains after the Greek lawmakers said “yes” to the austerity measures, necessary to get the â¬78 billion aid from the European Union. Some economists commented on this behavior of the currency pair “buy the rumor sell the fact”. The euro returned to upward movement at present. The US housing market showed a staggering recovery last month, adding to the pressure on EUR/USD. The US crude oil inventories are declining with accelerating rate. EUR/USD currently trades at 1.4394 after it climbed earlier to 1.4447, the highest level since June 15.

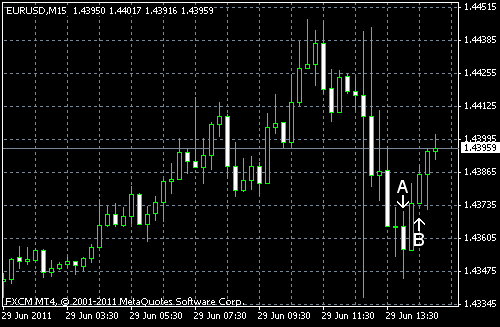

Pending home sales jumped 8.2% in May. That’s a very impressive result compared to the forecast growth by 2.4%. The April value was slightly revised from -11.6% to -11.3%. (Event A on the chart.)

Crude oil inventories decreased by 4.4 million barrels from the previous week and are above the upper limit of the average range for this time of year. Total motor gasoline inventories decreased by 1.4 million barrels last week and are in the middle of the average range. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please, reply using the form below.