- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: June 30, 2011

June 30

June 302011

Euro Push Even Higher as Traders Look for ECB Rates Hike

The euro jumped today for the fourth day, reaching the highest level in three weeks against the US dollar, on the speculation that positive changes in Greece’s situation will allow the European Central Bank to raise the interest rates next week. The ECB policy makers will meet on July 7 to set the lending rates. ECB President Jean-Claude Trichet reiterated his statement that the policy makers are in the state of “strong vigilance”. Market analysts […]

Read more June 30

June 302011

Sixth Quarter of Gains for Yuan

The Chinese yuan posted the sixth straight quarterly gain on the speculation that China will allow the currency to appreciate faster in order to slow growth of consumer prices. The Peopleâs Bank of China increased the reference rate for the yuan to 6.4716 per dollar today, allowing the currency to fluctuate 0.5 percent in either side of the target. Li Daokui, the adviser to the central bank, explained the rise of prices in June by higher costs of agricultural products and pork. China Securities […]

Read more June 30

June 302011

NZ Dollar Reaches Record vs. US Dollar on Business Confidence

The New Zealand dollar touched the all-time high against the US dollar today after the reports showed that the building approval advanced last month and the business confidence improved in June. The seasonally adjusted figure for the new building permits rose 2.2 percent in May, following the drop by 1.2 percent in April. The Business Confidence index of the National Bank of New Zealand was at 46.5 in June, up from 38.3 in May. The New Zealand dollar […]

Read more June 30

June 302011

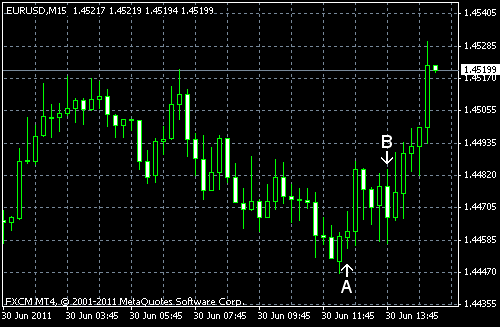

EUR/USD Sees No Losses This Week

Today we’ve seen the fourth day of EUR/USD rally. Economists expect that the European Central Bank will boost its interest rates next week. The business activity in the US improved this month, but unemployment wasn’t decreasing as fast as expected. EUR/USD trades at 1.4519 now. Initial jobless claims was at 428k in the week ending June 25, almost unchanged from the previous week’s figure of 429k, while they were […]

Read more