- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: July 21, 2011

July 21

July 212011

Euro Jumps as EU Leaders Make Plan to Help Greece

The euro surged today on the speculation that the leaders of the European Union will increase the size of the rescue fund and will accept a temporary Greece’s default, reducing threat of spreading of the debt crisis to other countries of the region. The European politicians strive to make a period of default for Greece as short as possible. The European Financial Stability Facility will support the nation. To do so, economists hope, the EFSF will increase its size and will back up Greek […]

Read more July 21

July 212011

Aussie Goes Lower as China’s Manufacturing Slows

The Australian dollar fell today after the report showed a slowdown of China’s manufacturing. The slowdown may curb demand for commodities and that, in turn, would hurt Australia’s economy. The Flash China Manufacturing PMI fell to 48.9 in July from 50.1 in June. The Flash China Manufacturing Output Index dropped to 47.2 this month from 49.8 in the month before. Both indexes were at 28-month low. Hongbin Qu, Chief Economist, China & […]

Read more July 21

July 212011

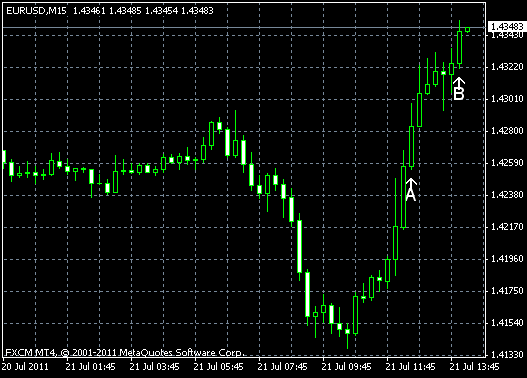

EUR/USD Jumps After EU Summit

EUR/USD jumped today after at the European Union summit a draft was devised, that should made a period of default in Greece as short as possible and would prevent the sovereign-debt crisis from spreading to other European nations. Today’s macroeconomic data showed that US manufacturing is regaining its footing, while unemployment claims increased above expectations. EUR/USD trades now at 1.4356. Initial jobless claims rose to 418k, even though […]

Read more July 21

July 212011

Pound Weakens on Worsening Consumer Sentiment

The Great Britain pound weakened today after the report showed that confidence of UK consumers declined last month, signaling that Britain’s economy won’t likely to improve in the near future. The Consumer Confidence Index of Nationwide Building Society fell from 55 to 51 in June. The assessment of the present economic conditions was stable and the main reason for the decline was the worsening outlook for the future of the UK economy. Retail sales increased 0.7 percent […]

Read more