- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: August 11, 2011

August 11

August 112011

Franc Plunges Heavily on Prospects of Euro-Peg

The Swiss franc slumped today against all major currencies as Swiss National Bank Vice President Thomas Jordan suggested that a short-term peg of the nation’s currency to the euro could be legal. The SNB was attempting to weaken the Swiss currency for several years. So far such attempts were futile. There is a difference this time, though, as a peg wouldn’t have just one-time effect as the previous interventions, but would […]

Read more August 11

August 112011

South Korea Holds Interest Rates, Won Goes Lower

The South Korean won declined today as the nation’s central bank kept the main interest rate unchanged, most likely influenced by threat of the European problems and the downgrade of the US credit rating for the global economy. The Bank of Korea held its seven-day repurchase rate at 3.25 percent. Such move wasn’t unexpected by markets. According to analysts, declining oil prices and a weak currency can help the economy of the Asian nation. USD/KRW went higher from […]

Read more August 11

August 112011

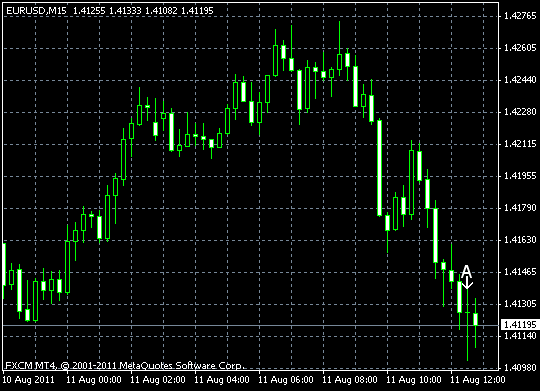

EUR/USD Slips Down with Unemployment Claims

EUR/USD was rising from the beginning of today’s trading session, but about 8:45 GMT it started decline that continues to the present time. The currency pair has got a small boost from the report that showed an increase of the US trade balance deficit, but the rally failed almost as soon as it started. Perhaps the positive jobless claims figure is responsible for such outcome. US trade balance had a deficit […]

Read more August 11

August 112011

Australia’s Dollar Rallies Despite Rising Unemployment

The Australian dollar jumped today as gains of US stocks and advance of commodities overshadowed the unfavorable report about employment in Australia The Standard & Poorâs 500 September futures advanced 1.7 percent, following yesterdayâs decline by 4.1 percent. The Thomson Reuters/Jefferies CRB Index of commodities gained 1.4 percent yesterday. The positive new from outside of Australia overshadowed the bad fundamentals in the country itself. The unemployment rate increased from 4.9 percent in June […]

Read more