- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: August 17, 2011

August 17

August 172011

Australia Dollar Receives Help from Commodities

The Australian dollar rose today, rallying to the highest price in almost two weeks against the US dollar, as commodities gained and increased appeal of growth-related currencies to Forex traders. The Leading Index of Melbourne Institute showed the annual growth of 0.1 percent in June. That’s not a bad result, compared to the 0.1 percent decline in the month before, but far below the long-term trend of 2.8 percent. The Wage Price Index rose 0.9 percent in the second […]

Read more August 17

August 172011

CAD Gains vs. USD as Investors Seek Higher Yield

The Canadian dollar advanced against its US counterpart as market sentiment improved, making investors more willing to risk and look for higher-yielding currencies. The currency was down against the euro and the yen. The Producer Price Index in the US, the major trading partner of Canada, rose 0.2 percent in July, following the drop by 0.4 percent in June. Market analysts expected no change. Futures on crude oil (the key Canadian export) gained 1.9 percent […]

Read more August 17

August 172011

Yuan Goes Down as Europe Saps Demand for Asian Assets

The Chinese yuan fell today as the central bank set the reference rate for the currency lower for the first time in six day after the European leaders failed to reach an agreement about measures for fighting the debt crisis. The European leaders were discussing yesterday the plans to issue joint euro-bond, but rejected that idea after all, making traders to question what exactly politician are going to do with the debt issues (and are they […]

Read more August 17

August 172011

SNB Doesn’t Mention Euro-Peg, Franc Resumes Rally

The Swiss franc gained today even after the Swiss National Bank announced yet another intervention. The explanation of such behavior is the fact that the Bank didn’t mention euro-peg, which it was considering, according to rumors. The SNB wrote today: The SNB has therefore decided to expand again significantly the supply of liquidity to the Swiss franc money market. Markets counted on euro-peg, when they were pushing the franc lower, and were […]

Read more August 17

August 172011

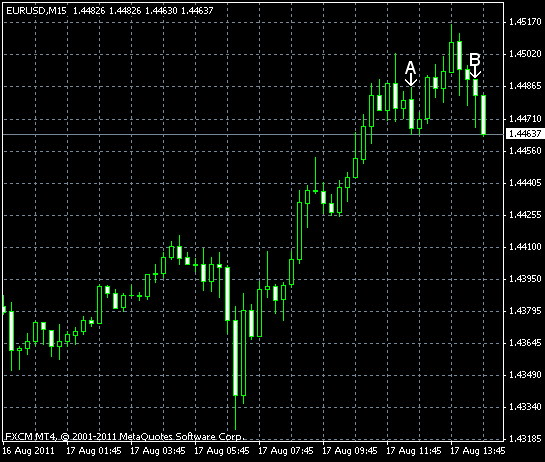

EUR/USD Surges Despite Debt Concerns

EUR/USD managed to jump today even after yesterday European leaders failed to reach agreement about measures to battle the debt crisis. The rally wasn’t caused by news from the US as there was not much US economic data today and what the released data was positive for the US anyway. PPI rose 0.2% in July, seasonally adjusted, following the 0.4% decrease in June. Market participants expected no change. (Event A on the chart.) […]

Read more