- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: October 28, 2011

October 28

October 282011

Loonie Higher vs. Euro, Lower vs. Yen as Concerns for Europe Return

The optimism about Europe has left markets and traders were leaving riskier currencies, especially the euro. As a result, the Canadian dollar fell versus the “safe” yen, but gained against the euro. The decline of most risky currencies followed the big jump after the plans for dealing with Europe’s crisis were revealed. Some analysts interpret such performance as a natural correction after an excessive rally, not as reverse of the trend. That’s to be seen, […]

Read more October 28

October 282011

Yen Continues to Strengthen

Japanese yen continues to strengthen, prompting Prime Minister Yoshihiko Noda to assure Japan’s parliament that leaders are ready to intervene if it becomes necessary. Japan prefers a weak currency, since it provides an advantage in the realm of exports. Indeed, a number of Japanese companies were hit hard in Quarter 3 due to a stronger yen. Japanese leaders are becoming nervous about how a stronger yen could slow exports, […]

Read more October 28

October 282011

Forex Traders More Cautious Today

Forex traders are showing a little more caution today, after yesterday’s enthusiastic shift toward risk appetite. Euro is moving a little lower against major counterparts now that traders are re-thinking the eurozone attempt to rein in sovereign debt. One of the issues for the euro today is that Italy’s debt rose in cost. As a result, Forex traders and others are once again looking at yesterday’s announcement from eurozone […]

Read more October 28

October 282011

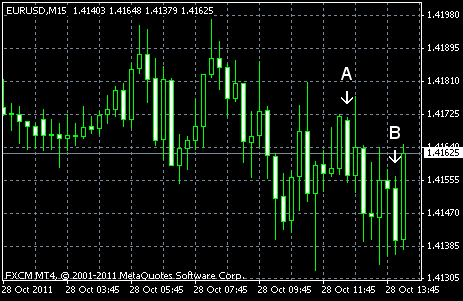

EUR/USD Falls as Optimism Wanes

The Great Britain pound gained today against the euro as the optimism caused by the rescue plans for the Eurozone quickly waned. The currency fluctuated against the dollar as the confidence of Britons declined. It’s surprising how fast the positive sentiment of traders turned to cautious stance, considering that previously optimism persisted on markets for a long time even without any positive news. This time optimistic went away as fast as it appeared and investors started to abandon […]

Read more October 28

October 282011

Baht Falls as Floods Overwhelm Thailand’s Capital

The Thai baht fell today on the outlook for slower economic growth and interest rate cut caused by the floods in Thailand’s capital. Assistant Governor Paiboon Kittisrikangwan said: The impact of the floods is severe and widespread, from the agricultural to the industrial sectors, and economic activities including exports, consumption and private investment are expected to slow. If the economy slows, there is a possibility that the central bank may ease monetary policy, but it has […]

Read more October 28

October 282011

Optimism Leaves FX Market, EUR/USD Down

EUR/USD declined today as yesterday’s optimism waned surprisingly fast. It’s interesting to see how long positive sentiment persisted on mere speculations earlier, but the actual positive developments of the situation in Europe weren’t able to keep optimism even for few days. The US fundamental data continues to provide conflicting signals. Michigan’s consumer confidence index rose, while the confidence index of Conference Board (released earlier this week) declined. Personal […]

Read more October 28

October 282011

Aussie Retreats After Jump

The Australian dollar retreated today after the yesterday’s surge on the speculation the currency gained to much and to fast to keep the gains. The Australian dollar, as well as other currencies with high yield, advanced yesterday as the European leaders described the planned measures to rescue the European Union from the debt crisis. The Aussie, as the currency nicknamed, reached the highest level in almost two months against the US dollar and the yen. Yet today the currency started the trading session with […]

Read more October 28

October 282011

Dollar Closes with Losses on Optimism About Eurozone

The US dollar headed to weekly losses against most major currencies as the Eurpoean leaders at last revealed some of their plans for solving Europe’s debt problems, damping need for safer currencies among investors. The nervousness that was building up before the plans were revealed made sure that a reaction to any tangible information about the plans of the European governments would be spectacular. The only question was would be that […]

Read more