- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: November 9, 2011

November 9

November 92011

CAD Heads Down as Italy Removes Risk Appetite from FX Market

The Canadian dollar was weaker today as the unfolding situation with the Italian debt decreased appetite for risk among participants of the Forex market. The yield for the 10-year Italian bonds soared to 7.25 percent. That the record since the times when the euro was implemented. Markets reacted negatively to this event. The Standard & Poorâs 500 Index fell as much as 2.9 percent, while the S&P/TSX Composite Index declined 1.8 percent. Futures on crude […]

Read more November 9

November 92011

Safe Haven Demand Sends US Dollar Surging

Safe haven demand is high today as Italy moves to the brink of default. With bond yields surging, and other eurozone countries fighting their own sovereign debt battles, Forex traders are looking for safe haven — and that means the US dollar. US dollar is surging today on the Forex market, especially against the euro. It seems that a crisis is a regular occurrence in the eurozone, and eventually leaders won’t […]

Read more November 9

November 92011

Rand Goes Lower as Moody Changes Outlook to Negative

The South African Rand slipped today as Moody’s Investor Service set the credit rating of South Africa to negative, reducing appeal of the nation’s currency. Moody’s reduced the outlook for the rating of South Africa’s sovereign debt to negative from stable today. The agency listed the reasons for such decision: 1. The growing risk that the political commitment to low budget deficits and the ability to keep within current debt targets could be undermined by popular pressures […]

Read more November 9

November 92011

Sterling Lower as Risk Aversion Sets In

Great Britain pound is struggling today, after seeing some gains yesterday. Today, though, equities are weighing on sterling as fears about the eurozone mount and result in risk aversion. The latest trigger in the sovereign debt drama is Italy’s bond yield. With the 10-year-bond yield beyond seven percent, it is little surprise that risk aversion is the name of the game today. Concerns still remain, in the background, about […]

Read more November 9

November 92011

Aussie Down Ahead of Employment Report

The Australian dollar edged down today as the pessimistic outlook for tomorrow’s employment report outweighed the positive fundamental reports today. Analysts estimated that Australian employment growth slowed to 10,100 jobs in October from 20,400 jobs in September. The unemployment rate is expected to increase from 5.2 percent to 5.3 percent. The report from the Australian Bureau of Statistics will be release tomorrow. The negative employment expectations overshadowed the soaring Westpac consumer […]

Read more November 9

November 92011

Flexible VPS Hosting with Severs in Germany — Host1Plus

Today, another Forex VPS company was added to the list on my site. It’s Host1Plus — a company working since 2008 (and offering its services to the general public since 2009). It doesn’t specialize in VPS for MetaTrader, but it can be used successfully for Forex trading. The price for the VPS ranges from $12.65/month (for 0.6 GHz + 256 MB RAM) to $362/month (for 9.6 GHz + 12 GB RAM). For each VPS […]

Read more November 9

November 92011

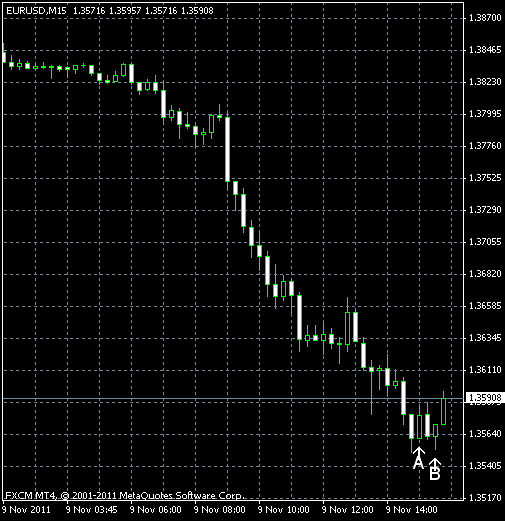

EUR/USD Sinks on Political Turmoil in Greece & Italy

EUR/USD slumped today as Greece struggles to form a new (temporary) government for the third day, while Italy will likely also lose leadership and nobody can guarantee that the nation will avoid problems with forming a new government. The fundamental reports were largely positive for the dollar, driving the currency pair further down. Tomorrow some important reports are expected, among them trade balance and jobless claims. Tomorrow’s data […]

Read more November 9

November 92011

Japanese Yen Gains on Uncertain Prospects for EU Economy

The Japanese yen gained today as some Forex market participants doesn’t consider the current political events in the European Union (namely, the resignation of Greek Prime Minister and the future resignation of Italian Prime Minister) as positive for the European economy. Such traders prefer to buy the Japanese currency as a safe haven. The change of leadership in Greece and Italy is considered to be good by many economists as previous leaders definitely weren’t able to deal with the problems of their […]

Read more November 9

November 92011

Euro Advances as Berlusconi Ready to Step Down

The euro rallied yesterday and done a good job keeping its gains today as Italian Prime Minister Silvio Berlusconi agreed to resign after the austerity measures will be implemented. Italy was contaminated by the Eurozone sovereign-debt crisis, sending the country’s bond yield soaring this summer. The resulting difficulties that the nation’s economy faced left Italy’s Prime Minister out of favor even among his allies. The desertion of allies caused […]

Read more