- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: December 21, 2011

December 21

December 212011

US Dollar Index Rises on European Uncertainty

Uncertainty about what’s next for the eurozone is prompting gains for the US dollar today, with the dollar index moving higher, heading for the 80 level. Concerns about the eurozone once again dominate, and the US dollar is moving higher as a result. Earlier, the ECB began a three-year lending program for banks in the eurozone. The program is designed to keep the credit markets liquid during this time, so that interbank lending remains strong. […]

Read more December 21

December 212011

Euro Lower as Banks Take Three-Year Loans from ECB

Today, for the first time, the European Central Bank began offering three-year loans as part of a plan to provide struggling countries with the funding to avoid collapsing due to the debt crisis. Even though the measure is supposed to help eurozone countries, the euro has slipped against other major currencies. The ECB is offering three-year loans to banks, and more than 500 have taken advantage of the loans, with a demand of more than 480 […]

Read more December 21

December 212011

Pound Higher Despite Confusing Consumer Confidence Reports

The Great Britain pound advanced despite the consumer sentiment report was negative today. On the other hand, yesterday’s report showed positive developments, making traders confused. The explanation of the difference could be that one report is for December and another is for November. The Nationwide consumer confidence index rose from 36 to 40 in November from the preceding month. The GfK index dropped from -31 to -33 in December, the lowest level in almost […]

Read more December 21

December 212011

Ringgit Advances as US Housing Improves

The Malaysian ringgit rose today together with other Asian currencies after the report yesterday showed that the US housing sector improved. The positive data improved prospects for the Asian exports. The housing starts rose to 685,000 in November from 627,000 in October. The housing starts advanced to 681,000 in the last month from 644,000 in the month before. Both were expected to decline. The MSCI Asia-Pacific Index of stocks gained as much as 2.3 percent, showing […]

Read more December 21

December 212011

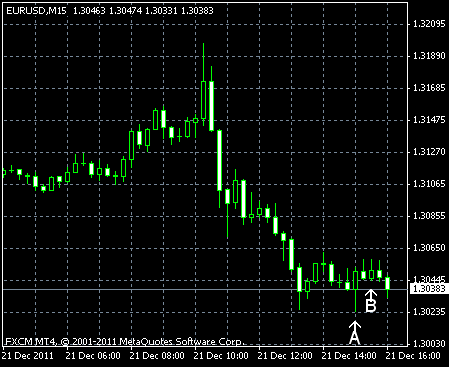

EUR/USD Slumps After Rally as ECB Fails Ease Concerns

EUR/USD was rising today, but later dropped sharply. The European Central Bank was providing loans today to support the eurozone economy, but the bank’s effort failed to alleviate the fears of the debt crisis. Today’s report confirmed that the US housing market is improving, even though the actual reading was below the median forecast. Existing home sales rose to a seasonally adjusted annual rate of 4.42 million in November from […]

Read more December 21

December 212011

New Zealand Dollar Gains as Optimism Hits Forex Market

The New Zealand dollar advanced today, extending its gains from yesterday, as Forex market participants felt a bit more optimistic about Europe and favored higher-yielding assets. The resulting rally of the global stocks was also beneficial to the currency. The European Central Bank will announce the results of the first tranche of its unlimited three-year loans today. Economists think that banks will use the loaned money to buy the sovereign debt. The Standard […]

Read more December 21

December 212011

Traders Again Willing to Risk, Benefiting Canada’s Dollar

The Canadian dollar advanced today as the prices for crude oil rose and stocks gained after risk appetite reemerged on markets and traders again became interested in riskier assets. Crude oil futures advanced as much as 3.8 percent to $97.59 per barrel in New York. The Standard & Poorâs 500 Index rose 3 percent, while the S&P/TSX Composite Index climbed 1.5 percent. The risk appetite appeared after Europe’s good data […]

Read more