- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: February 28, 2012

February 28

February 282012

Canadian Dollar Clings to Gains

Canadian dollar is clinging to gains, struggling to retain the upper hand as risk aversion begins to creep into the picture. Loonie is slightly higher against the US dollar, as well as against the UK pound and the euro. US durable goods orders contracted more than expected in January. Some expected that news to take a bigger toll on the Canadian dollar, since the United States is Canada’s biggest trading partner. However, the news […]

Read more February 28

February 282012

Retail Sales Data Helps UK Pound against US Dollar

UK pound is higher against the US dollar today, gaining on better retail sales data. The expectation now is that Great Britain will avoid a recession, and that is providing sterling with a little support today. The Confederation of British Industry reported a change to minus 2 on its index in February — up significantly from January’s minus 22. The news is supporting the idea that Great Britain’s economy […]

Read more February 28

February 282012

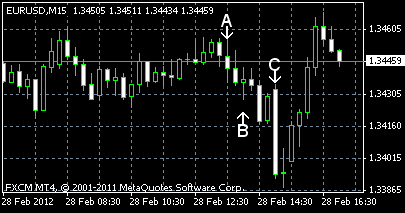

European Central Bank Helps EUR/USD Advance

EUR/USD advanced today as the European Central Bank prepares to distribute unlimited three-year funds among European banks. The currency pair was down yesterday as Group of Twenty refused to help Europe and Standard & Poor’s reduced Greece’s credit rating to selective default. Economic data from the United State wasn’t particularly good today. Consumer sentiment improved and manufacturing continued to expand, but durable goods orders and the S&P/Case-Shiller home price […]

Read more February 28

February 282012

AUD/USD Falls for Second Session on Prospects of Greek Default

The Australian dollar kept its gains against the US currency and the euro, but continued to fall versus the Japanese yen after Standard & Poor’s reduced Greece’s credit rating to selective default. Commodity currencies were under pressure at the beginning this week as the Group of Twenty declined Europe’s request for help unless the European Union would bolster its firewall to prevent spreading of the financial crisis. Market sentiment was further hurt […]

Read more February 28

February 282012

Euro Remains Weak as S&P Reduces Greece’s Rating to Selective Default

The euro remained weaker against other major currencies after yesterday’s slump as Standard & Poor’s reduced Greece’s credit ratings to selective default, adding to concerns about Europe’s debt woes. S&P cut Greece long-term and short-term ratings to SD (selective default) yesterday. The rating agency explained its decision: We lowered our sovereign credit ratings on Greece to ‘SD’ following the Greek government’s retroactive insertion of collective action […]

Read more