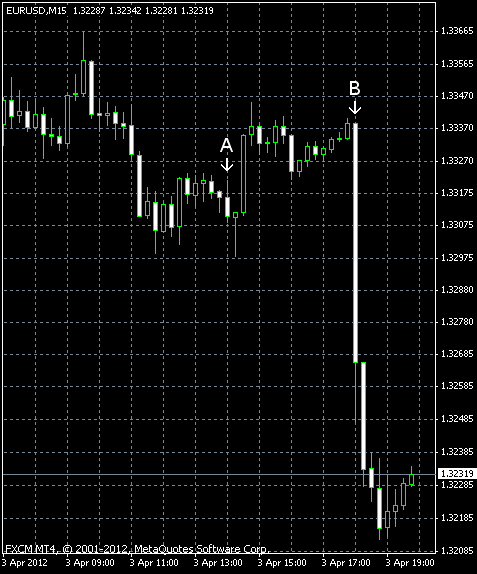

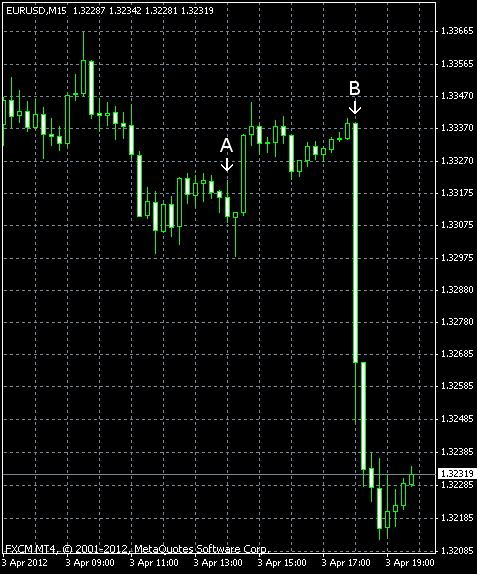

EUR/USD slid today as the minutes of the FOMC monetary policy meeting showed that the Federal Reserve isn’t planning quantitative easing. The currency pair was trading sideways for the most part of the trading session, but slumped after the minutes were released.

Factory orders rose 1.3% in February. The actual value was somewhat below forecast of 1.5%, but much better than the January figure of -1.1%. (Event A on the chart.)

The Federal Open Market Committee minutes showed that the current monetary policy is likely to be maintained at least till late 2014. The minutes said:

In their discussion of monetary policy for the period ahead, members agreed that it would be appropriate to maintain the existing highly accommodative stance of monetary policy.

Some member of the Committee warned that additional stimulus may be required if the economic recovery would lose momentum or if inflation would stay below target 2 percent. In contrast, one member thought that stimulus should be reduced before 2014. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.