- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: April 12, 2012

April 12

April 122012

Australia’s Employment Shows Huge Growth, AUD Surges

The Australian dollar jumped today as employment in Australia demonstrated surprisingly huge growth that was about seven times above forecasts, causing speculation that the nation’s central bank will refrain from an interest rate cut. The Australian Bureau of Statistics reported that the seasonally adjusted number of employed persons rose by 44,000 in March from February. That’s compared to the much smaller figure of 6,400 predicted by analysts. Australian employment decreased […]

Read more April 12

April 122012

Euro Rises In Spite of New Concerns

Euro is gaining today, even though concerns remain about Spain and other countries in the eurozone with high amounts of sovereign debt. Continued worries about the eurozone are not enough to keep the euro down as Forex traders show disappointment with US dollar policy. Recently, gains for the US economy have led some Forex traders to speculate that the Federal Reserve would move up its timetable for interest […]

Read more April 12

April 122012

Swiss Franc Gains, SNB Ready to Maintain Ceiling

The Swiss franc rose today against the US dollar, following gains of the euro. The currency fluctuated against the euro, staying near the cap, but not breaking it. The Swiss National Bank capped the franc at 1.20 per euro last year and the currency has breached the ceiling only once on April 5. Central bank’s interim chief Thomas Jordan assured that the SNB is ready to buy foreign currency in unlimited quantities […]

Read more April 12

April 122012

US Dollar Remains Lower in Currency Trading

US dollar is lower today, falling as warnings about the slow economic recovery in the United States remain intact. The US dollar doesn’t look as attractive as it did a couple of weeks ago, and disappointing economic data in the United States is only confirming that view. US economic data is showing that recovery continues at a rather slow pace. Last week, initial jobless claims rose to 380,000, once again […]

Read more April 12

April 122012

Rand Gains on Fed & ECB Stimulus

The rand rose today, following two days of decline, on signs that the US Federal Reserve and the European Central Bank plan to stimulate their economies, supporting inflow of higher-yielding assets. Janet Yellen, a member of the Federal Open Market Committee, said that the US economy needs stimulus despite signs of recovery: I consider a highly accommodative policy stance to be appropriate in present circumstances. But considerable uncertainty surrounds the outlook, and I remain prepared […]

Read more April 12

April 122012

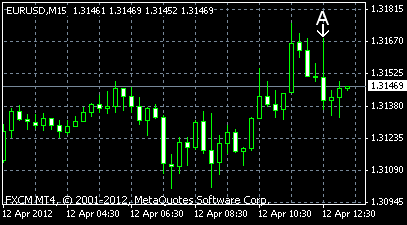

EUR/USD Climbs for Second Day

EUR/USD rose for the second day today, though it retreated a little after a report showed that the US trade deficit shrank more than expected. Additionally, some members of the Federal Reserve signaled that quantitative easing is still possible. Rising jobless claims and stalling PPI supported the case for further easing. PPI showed no change in March, while an increase by 0.3% was predicted by analysts. The index was up […]

Read more April 12

April 122012

NZD Climbs as Business Confidence Improves, Manufacturing Expands

The New Zealand dollar advanced today, rising for the second trading session, as macroeconomic reports showed that business confidence improved and manufacturing continued to expand, confirming positive developments in the New Zealand economy. New Zealand Institute of Economic Research reported that business confidence index rose from 0 to 13 in the first quarter of 2012. Business NZ manufacturing index was down from 57.7 in February to 54.5 in March, but is […]

Read more