- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: April 30, 2012

April 30

April 302012

Australian Dollar Falls as Traders Anticipate Interest Rate Cut

The Australian dollar fell today on speculation that the Reserve Bank of Australia will cut its main interest rate as the European problems cause a negative impact on Australia’s economy. The RBA holds a monetary policy meeting tomorrow and is expected to cut its main interest rate to 4 percent from the current 4.25 percent. Analysts think that the previous statements of the central bank were dovish enough to show willingness of the bank to ease […]

Read more April 30

April 302012

Canadian GDP Disappoints, Sending Loonie Lower

Canadian GDP surprised analysts and traders to the downside today, with February GDP declining 0.2%. The news came at the same time that reports of slowing consumer spending and income were reported in the United States. The combination is weighing on the Canadian dollar today, as well as on other currencies. The drop in Canadian GDP is being blamed, to some extent on oil and mining shutdowns that occurred in Canada. The result was that expectations were missed […]

Read more April 30

April 302012

US Dollar Index Recovers Somewhat as Other Majors Show Vulnerability

US dollar index is recovering somewhat today, thanks to vulnerability shown by some of the other majors today. Once again, the euro is showing a degree of weakness in forex trading, as is the pound. The yen, however, is higher against the US dollar today as a measure of risk aversion makes an appearance. A lot of what is helping the US dollar today is based around the idea that perhaps the Federal Reserve‘s recent announcement […]

Read more April 30

April 302012

South Korean Manufacturers Feel Confident, Won Jumps

The South Korean won climbed today as nation’s manufacturer confidence jumped to the nine-month high and hopes for growth of the US economy boosted prospects for higher-yielding assets of emerging markets. The Bank of Korea reported that the index of South Korean manufacturers’ outlook for May climbed to 90 from 85 for April, reaching the highest level since August 2011. The index for non-manufacturing sector expectations was up from 82 to 85. The won also gained as the growing […]

Read more April 30

April 302012

Euro Slips as Spain Enters Recession

The euro fell today as Spain’s economy entered a recession, fueling concerns that the financial crisis is spreading across Europe. That was the first day of decline against the dollar after four days of gains and the third consecutive session of losses against the yen. Spain’s gross domestic product fell 0.3 percent in the first quarter from the previous three months. The economy shrank at the same rate in the fourth quarter of the previous year, meaning […]

Read more April 30

April 302012

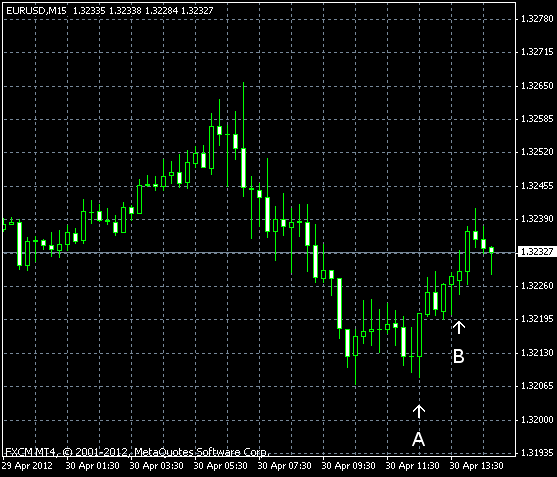

EUR/USD Trades Sideways, Erasing Earlier Losses

EUR/USD fell today after a report showed that Spain entered a recession, but later the currency pair rebounded and traded in a wide range. Currently, the euro stays flat. The US economic data was somewhat worse than expected and definitely worse than the previous reports. Personal income and spending increased in March. Income rose 0.4%, while analysts expected growth to stay at the same 0.3% as in February. Spending growth was 0.3%, […]

Read more