- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: June 26, 2012

June 26

June 262012

US Dollar Weak as Bad Data Means Higher Probability of QE3

The US dollar was weak today as reports about manufacturing and consumer sentiment were unexpectedly bad, spurring speculations that the Federal Reserve may yet turn to quantitative easing as a way to bolster the faltering economic recovery. The greenback was almost flat against the euro. The Federal Reserve Bank of Richmond reported that its manufacturing index slipped from 4 in May to -3 in June. Most analysts believed that the index would […]

Read more June 26

June 262012

CAD Stronger in Spite of Negative Factors

The Canadian dollar gained today even as the negative factors that were previously weakening the currency remained. Yet Forex market participants felt inclined to buy higher-yielding currencies even during these times of uncertainty. The environment on the FX market remained the same: negative for riskier assets. Yet the loonie ignored that. Perhaps, an unexpected surge of optimism on other markets was responsible for the strength of Canada’s currency. Futures on crude oil added 0.2 […]

Read more June 26

June 262012

Euro Lower Ahead of EU Summit

The upcoming European Union summit is doing little to help calm nerves right now. While there are grand plans being laid, few people expect a true breakthrough from the summit, and there is an expectation that the situation will remain largely the same at the end of the meeting. One of the plans that might be presented at the meeting is expected to be the proposition of a tighter European Union. A document that is expected […]

Read more June 26

June 262012

UK Pound Gets a Boost, Even with Bigger Deficit

Even though the UK pound saw a bigger than expected deficit, the UK pound is getting a boost today. Sterling is higher as some observers think that the latest developments will result in an end to the strict austerity measures, and help the United Kingdom start spending a little more to ease the current recession. Right now, the UK pound is heading higher, even though risk appetite isn’t very apparent in the markets […]

Read more June 26

June 262012

Mexican Peso Pares Gains on Fears of Global Economic Slowdown

The Mexican peso gained today, but erased its gains on speculations that the slowing global economic growth may have a negative influence on prospects of Mexico’s economy. The peso was down yesterday, but rebounded today. The gains were limited, though, because of uncertainty that prevails on the Forex market ahead of this week’s EU summit. Banco de Mexico said in its policy meeting minutes that the balance of risks for the nation’s […]

Read more June 26

June 262012

Aussie Rebounds on Positive Outlook for Australia’s Economy

The Australian dollar rebounded today after yesterday’s decline as the positive outlook for Australia’s economy damped the negative effect of the European crisis on the attractiveness of the currency. Concerns about the debt issues in the countries of the European Union have led to interest rate cuts by the Reserve Bank of Australia. That made the Aussie weaker. Yet the cut were followed by positive macroeconomic data, causing speculations that the Australian economy is strong enough to weather the crisis in Europe. […]

Read more June 26

June 262012

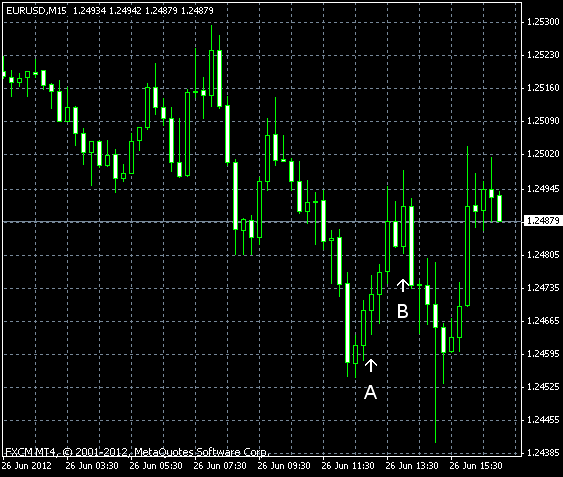

EUR/USD Falls on Borrowing Costs, Trims Losses on US Data

EUR/USD dropped today as borrowing costs surged on today’s Spanish and Italian debt auctions. The currency pair trimmed its losses as poor fundamental data from the United States spurred speculations that QE3 may be imminent. Housing data was actually not bad, but manufacturing and consumer sentiment reports were unexpectedly poor. S&P/Case-Shiller home price index rose from 137.63 in March to 138.55 in April. Year-on-year, the index […]

Read more June 26

June 262012

Canadian Dollar Slides as Poor Market Sentiment Weakens Commodities

The Canadian dollar sank as negative sentiment on the Forex market drove investors away from currencies related to economic growth and commodities. The currency advanced versus the euro, though. Shaun Osborne, the chief currency strategist at Toronto-Dominion Bank TD Securities unit, said: The US dollar is starting to pick up some momentum against the Canadian dollar from here. We have commodity prices that look quite soft. Indeed, commodities, […]

Read more