- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: July 2, 2012

July 2

July 22012

Euro Retreats on ECB Rates Speculations & Rising Unemployment

The euro retreated today, following the huge gains on Friday, as the eurozone unemployment rate rose and investors speculated that the central bank may decrease its interest rates. Eurostat reported that the eurozone unemployment rate rose to 11.1 percent in May from 11.0 in April. The increase was small and expected by market participants. Still, it reminded traders that problems of the region are not solved and it is too early too […]

Read more July 2

July 22012

UK Pound Down Against Dollar, But Higher Against Euro

UK pound is mixed today, due to the situation in the markets. Pound is down against the US dollar as the risk rally from last week loses steam, but higher against the euro as traders wonder if the deals made at the European Union summit last week will actually last. Risk appetite has been fading as concerns about the US economy and the global economy rise. Additionally, there is some profit […]

Read more July 2

July 22012

US Dollar Rises as Uncertainty Shows Through

Last week ended with a spectacular rally by risky assets. This week, though, appears to be reversing course, at lease a little bit. Risk assets are pulling back in light of some developments regarding the US economy. Manufacturing activity is weighing on risk currencies, and providing something of a boost for the US dollar. US dollar is heading higher today, gaining as concerns about the economy rise, and some forex traders engage […]

Read more July 2

July 22012

Yuan Gains on Better-Than-Expected Manufacturing PMI

The Chinese yuan advanced today after a report showed that China’s manufacturing sector slowed less than was predicted by analysts. Yet there was another, less optimistic, report. China Federation of Logistics and Purchasing reported that the Purchasing Managers’ Index decreased from 50.4 in May to 50.2 in June. The value was above analysts’ expectations and still indicated expansion, albeit with slower pace. The report from HSBC Holdings […]

Read more July 2

July 22012

Mexican Peso Gains, Pulls Back

The Mexican peso gained today as Enrique Pena Nieto was leading in the presidential elections according to a poll. The peso pulled back, like many other currencies today, as Friday’s gains were to big too sustain. Pena Nieto was leading in the elections, according the survey of the Federal Electoral Institute. He promised to bolster economic growth and boost private sector, sparking hopes that reforms would improve the nation’s economy. The peso rallied […]

Read more2012

Trading Forex While on Vacation?

Even Forex traders should take some rest from the markets. Part-time FX traders usually have other jobs and often go on vacation to distant places with no convenient way to follow the currency market or keep up with daily trading. That creates a problem of the positions left open and unattended, while using some hotel’s lousy WiFi connection and a mobile trading platform is rarely a good way to deal […]

Read more July 2

July 22012

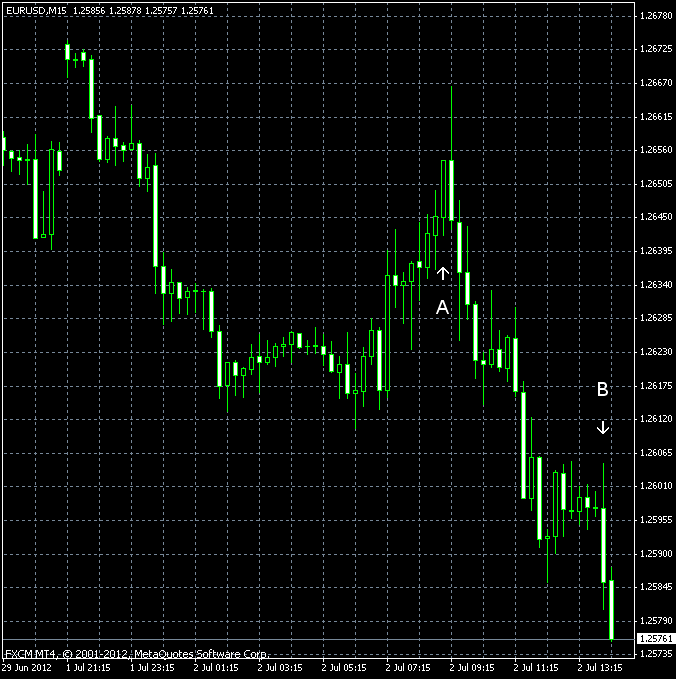

EUR/USD Pulls Back After Friday’s Jump

EUR/USD pulled back today, following the Friday’s rally. That was not a surprise as the gains were too big for such a short time and were hardly sustainable. Additionally, the unemployment rate in the eurozone rose somewhat (event A on the chart), reducing appeal of the euro. The manufacturing sector in the United States unexpectedly declined last month, while construction spending grew faster than anticipated. ISM manufacturing PMI was at 49.7% in June. That was […]

Read more