- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: August 2, 2012

August 2

August 22012

CAD at Record High vs. EUR

The Canadian dollar jumped to the record high against the euro today after the European Central Bank disappointed Forex market participants. The ECB refrained from any serious steps to address the issues of the eurozone. It is not surprising that the loonie gained on the euro, falling versus the US dollar and the Japanese yen at the same time. FX traders expected some noticeable actions from the ECB after central bank’s President Mario Draghi […]

Read more August 2

August 22012

Euro Drops on Draghi Disappointment

Euro is dropping today, thanks in large part to the disappointment over Mario Draghi‘s policy announcement from the ECB. Many had expected the ECB to announce measures to help ease the sovereign debt. At the very least, there were expectations that the ECB would buy Spanish and Italian bonds. However, Draghi’s “whatever it takes” rhetoric might just that: Rhetoric. Instead of announcing any changes, the ECB is staying the course. […]

Read more August 2

August 22012

Risk Aversion Sends Japanese Yen Higher, Officials Fret

Japanese officials are fretting about the strength of the Japanese yen again. Recent risk aversion is sending the yen higher against other majors today. Concerns about the eurozone are on the rise yet against, and the yen is being used as a safe haven. After the strong statement recently, many Forex traders had expected some decisive action from the European Central Bank. However, when it came right down […]

Read more August 2

August 22012

Pound Rises vs. Dollar as BoE Does Not Add Stimulus

The Great Britain pound rose against the US dollar and trimmed its losses versus the euro and the Japanese yen today after Bank of England refrained from expanding its stimulating program. The BoE announced today that it kept its main interest rate and bond purchasing program unchanged: The Bank of Englandâs Monetary Policy Committee today voted to maintain the official Bank Rate paid on commercial bank reserves at 0.5%. The Committee […]

Read more August 2

August 22012

Aussie Rallies on Growing Retail Sales & Trade Surplus

The Australian dollar rallied today as the positive macroeconomic data led to speculations that the Reserve Bank of Australia would leave its interest rates unchanged at the policy meeting next week. Australian retail sales rose 1.0 percent in June, month-on-month. The increase was above the expected change of 0.6 percent and the revised May advance of 0.8 percent. The trade balance posted the surplus of A$9m in June. That is not big, but much […]

Read more August 2

August 22012

EUR/USD Sinks as FX Market Gets Another Disappointment, This Time from ECB

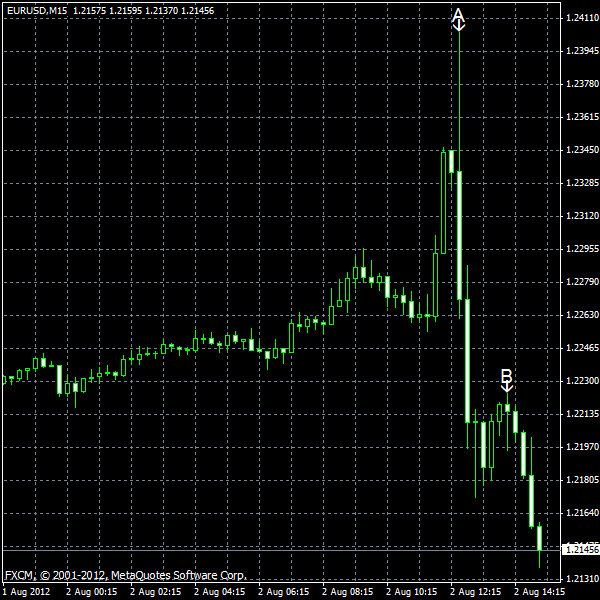

EUR/USD was rising today, but dropped sharply after the European Central Bank refrained from decisive actions to bolster the failing economy of the eurozone (event A on the chart). Last week, ECB President Mario Draghi promised to do all that is necessary to support the euro and market participants expected the promise to translate in something material on today’s policy meeting, but such expectations proved to be wrong. Initial jobless claims (seasonally […]

Read more