- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: August 16, 2012

August 16

August 162012

Hopes for End of Crisis Bring Euro Higher

The euro was higher today against all of most-traded currencies as investors speculated that the European leaders would take steps to ease the negative influence of the sovereign-debt crisis and would seek a way out of the current detrimental economic state. German Chancellor Angela Merkel reiterated her pledge to work with the European Central Bank to find a cure for the debt disease that plague the European Union. The comments alleviated fears that Germany would […]

Read more August 16

August 162012

Risk Appetite Appears and Sends US Dollar Lower

Risk appetite is making a somewhat cautious appearance on the markets today. Equities in Europe and the United States are mostly higher, and there is optimism regarding the ECB’s inevitable moves to stave up complete collapse in the eurozone. As a result, the US dollar is moving a little lower today. Greenback is down against the European currencies today as risk-on puts in an appearance. UK pound and euro are both gaining against the US dollar. […]

Read more August 16

August 162012

Japanese Yen Lower on Easing Expectations

Japanese yen is lower today, sliding against major currencies as traders express their expectations for monetary easing by the Bank of Japan. Between US Treasury yields and possible BOJ easing, the yen is likely to continue losing ground to other currencies. Bank of Japan officials stand ready to ease if needed, in order to help boost the economy. Monetary easing is a deliberate method of weakening the currency in an effort at economic stimulus. Many […]

Read more August 16

August 162012

Ringgit Falls on Europe, Supported by Domestic Growth

The Malaysian ringgit fell today, following other Asian currencies in decline, on fears that the European debt crisis would hurt demand for exports from Asia. The losses were limited as growth of the Malaysian economy beat forecasts. Malaysia’s gross domestic product grew 5.4 percent in the second quarter of this year from a year ago, following the expansion by 4.9 percent in the second quarter. The report surprised economists pleasantly as they were expected […]

Read more August 16

August 162012

Sterling Advances with Unexpected Increase of Retail Sales

The Great Britain pound jumped today, erasing its earlier losses versus the US dollar, as retail sales unexpectedly increased, giving hope that the UK economy is in a better shape than was previously considered. UK retail sales advanced 0.3 percent in July from the previous month on a seasonally adjusted basis. That was a pleasant surprise for market participants as the consensus forecast predicted no change. Moreover, the June growth […]

Read more August 16

August 162012

EUR/USD Rises After Two Days of Decline

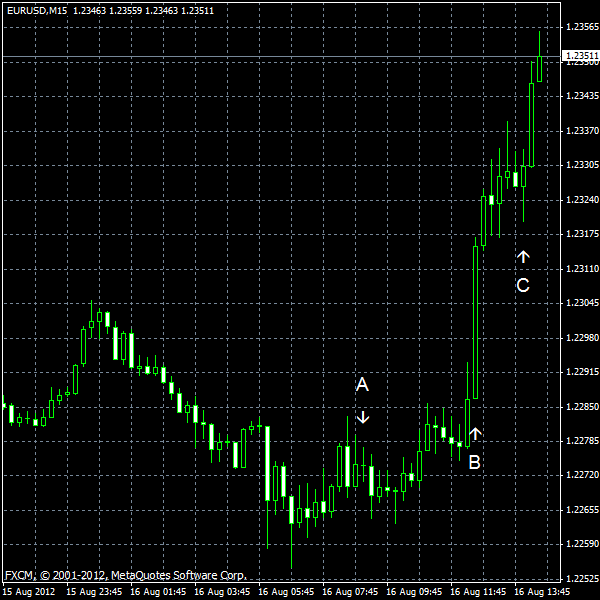

EUR/USD was falling slowly today, but stopped its decline and sharply jumped after the report showed that eurozone inflation remained stable last month. (Event A on the chart.) The data from the United States was also positive as building permits increased, the manufacturing index improved and unemployment claims were almost unchanged. Housing starts dipped from 754k to 746k in July, while a small increase to 760k was expected. Housing […]

Read more August 16

August 162012

Euro Falls as Greece Takes Headlines Again, Rebounds

The euro fell yesterday as fears about Greece’s exit from the eurozone resurfaced, driving investors away from the shared European currency. Today, the euro managed to pare its losses and gained against other majors. Greece’s Prime Minister Antonis Samaras are going to meet other European leaders to convince them to ease the terms of the aid. Additionally, Greece may ask for another tranche of the bailout. The problem is that Germany’s leaders […]

Read more