- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: August 22, 2012

August 22

August 222012

Rand Falls with Slowing Inflation

The South African rand fell today after the data showed that consumer inflation slowed last month, triggering speculations that the nation’s central bank would cut its interest rates on the next policy meeting. The Consumer Price index fell to 4.9 percent in July from 5.5 percent in June. Analysts expected a drop, but thought it would smaller — to 5.2 percent. The unfavorable domestic fundamentals added to worries […]

Read more August 22

August 222012

US Dollar Gains the Upper Hand Today

US dollar is gaining the upper hand today as uncertainty makes its appearance. At first there was profit taking from yesterday’s gains against the US dollar, but now there is a bit of an edge to the markets as investors and Forex traders await more information. Greenback is gaining against high beta currencies today, particularly the euro and the loonie, as Forex traders wait for the latest round of economic data. There is […]

Read more August 22

August 222012

Japan’s Trade Deficit Widens, EUR/JPY Falls

The Japanese yen advanced today against the euro and was little changed versus the US dollar after the report showed that the nation’s trade balance deficit widened last month, adding to signs of global economic slowdown. The Ministry of Finance reported that Japan’s trade balance posted a deficit of ¥0.33 trillion. That was a little increase from the deficit of ¥0.32 trillion, but the actual value was much smaller than the predicted […]

Read more August 22

August 222012

Canadian Dollar Pulls Back as Risk Aversion Returns

After a bit of optimism, risk aversion is creeping back, and that is pulling the Canadian dollar down against the US dollar. Stocks are pointing to a lower open today, and European stocks are heading lower. However, the recent losses aren’t all due to risk aversion; there’s been some profit taking as well. Yesterday, loonie appreciated to its highest level since early May, thanks to optimism that the ECB […]

Read more August 22

August 222012

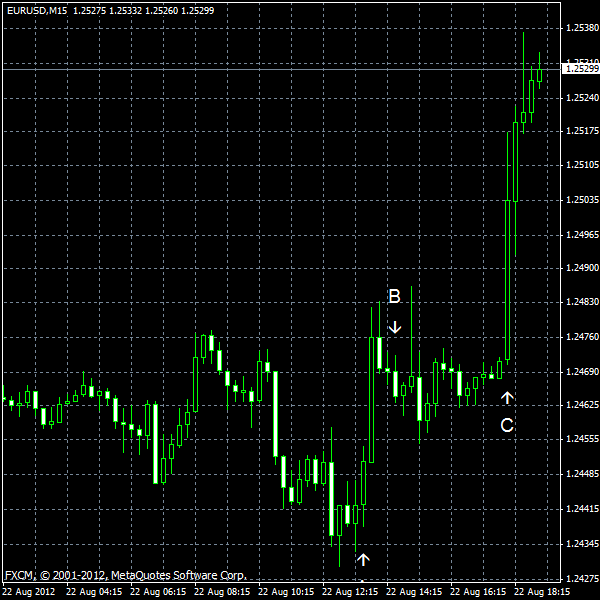

QE3 Still Possible? FOMC Minutes Say “Yes”, EUR/USD Goes Higher

EUR/USD rose for the third session in a row today after the FOMC signaled that the third round of quantitative easing is possible and rather soon. Traders were wondering if the Federal Reserve still considers QE3. The minutes showed that the Fed indeed thinks about stimulating the economy. Employment is not improving as fast as the central bank wants and some stimulating measures are likely. Existing home sales ticked up to 4.47 […]

Read more August 22

August 222012

NZ Dollar Falls on Pessimistic Outlook for PMI Reports

The New Zealand dollar retreated today as traders were afraid that tomorrow’s reports would show that manufacturing has slowed in China and the eurozone. Decline of manufacturing means falling demand for New Zealand’s exports and, as a result, currency. PMI data for Europe and China will be tomorrow and economists are worried that it would show slowdown of manufacturing. The Federal Reserve will release the minutes of its last policy meeting […]

Read more August 22

August 222012

ECB Ready to Start Bond Buying? Traders Hope So — Euro Jumps

The euro jumped today on speculations that the European Central Bank is ready to initiate its program of unlimited bond buying. The shared 17-nation was rising since it has reached the multi-year low in July (and against several currencies it has touched record lows). How long the rally would continue is anybody’s guess. There were rumors that the ECB is ready to start unlimited purchases of sovereign debt […]

Read more