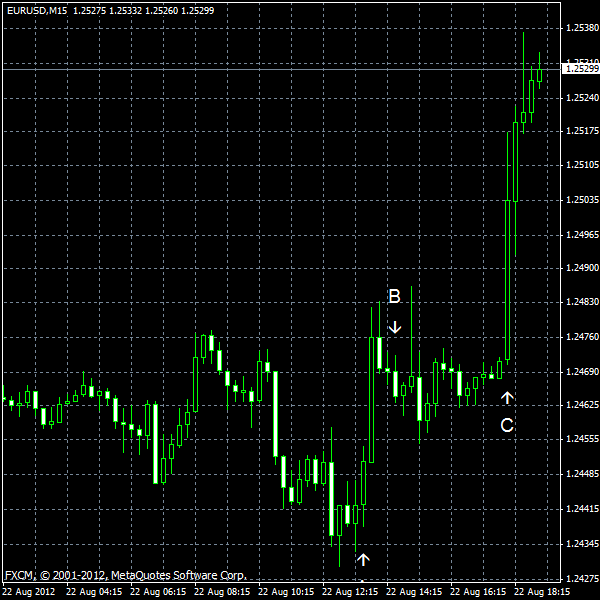

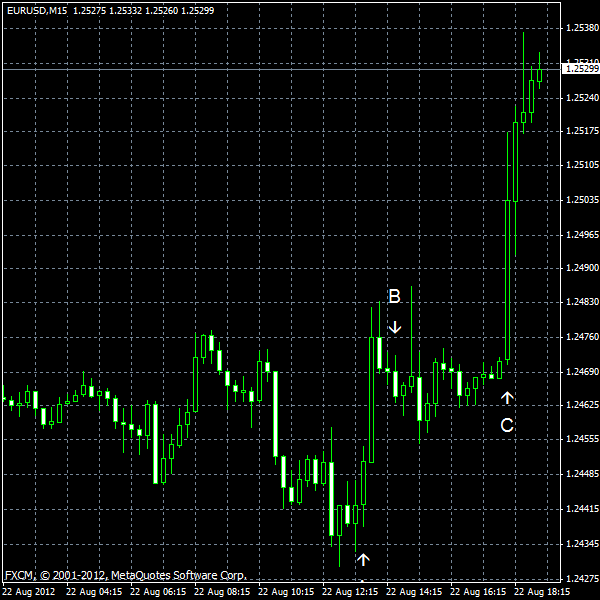

EUR/USD rose for the third session in a row today after the FOMC signaled that the third round of quantitative easing is possible and rather soon. Traders were wondering if the Federal Reserve still considers QE3. The minutes showed that the Fed indeed thinks about stimulating the economy. Employment is not improving as fast as the central bank wants and some stimulating measures are likely.

Existing home sales ticked up to 4.47 million in July from 4.37 million in June (seasonally adjusted). Market analysts had even higher expectations of 4.37 million. (Event A on the chart.)

Crude oil inventories decreased by 5.4 million barrels and total motor gasoline inventories decreased by 1.0 million barrels last week. (Event B on the chart.)

The Federal Open Market Committee released the minutes of its monetary policy meeting on August 1. (Event C on the chart.) The minutes show that the policy makers consider the probability of QE3 quite likely:

Many members judged that additional monetary accommodation would likely be warranted fairly soon unless incoming information pointed to a substantial and sustainable strengthening in the pace of the economic recovery.

If you have any comments on the recent EUR/USD action, please reply using the form below.