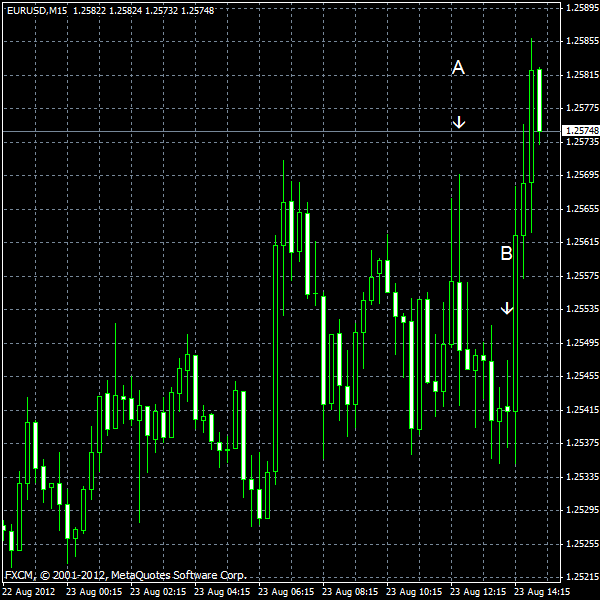

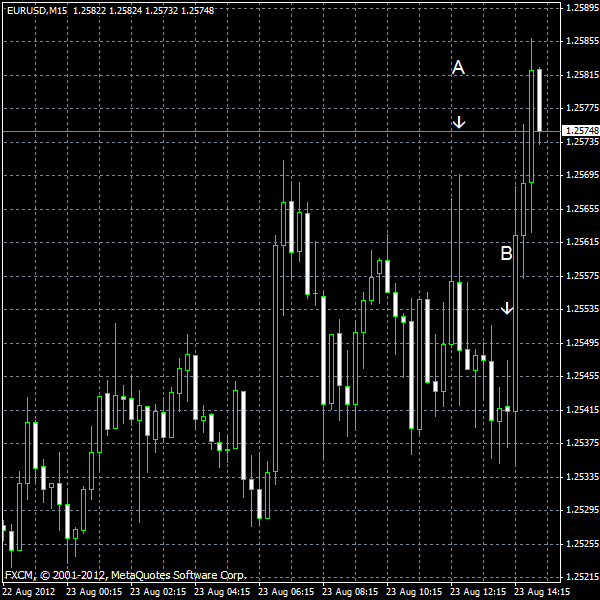

EUR/USD rose today for the fourth straight session after increasing US jobless claims increased chances that the Federal Reserve would implement quantitative easing yet again. Yesterday, the Fed policy minutes spurred speculations about to QE3 and today’s data spurred the talks further. The housing market looked good as new home sales increases last month more than expected.

Initial jobless claims rose from 368k to 372k last week. That is instead of a small decline to 365k that was predicted by forecasters. (Event A on the chart.)

New home sales were at a seasonally adjusted annual rate of 372k in July, while the median forecast was 363k. The June value was revised from 350k to 359k. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.