- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: August 28, 2012

August 28

August 282012

US Dollar Forecast: Waiting for Jackson Hole

US dollar is lower pretty much across the board as optimism about the eurozone adds a little risk appetite to the mix. Also not helping the US dollar is the fact that some are wary of what Ben Bernanke will say in Jackson Hole on Friday. The highlight of this week, even though consumer sentiment data is on the docket, and Case-Shiller news is expected, is going to be Ben Bernanke’s August […]

Read more August 28

August 282012

Euro Sees Gains, But Upside is Likely Limited

Euro is heading higher today as Forex traders assume that the European Central Bank will act to alleviate some of the issues with the sovereign debt situation. However, gains are likely limited, since no one has details, and possible actions are only rumors. Euro is getting a bit of a boost since the assumption is that the ECB will not let the euro fail â even if Germany balks […]

Read more August 28

August 282012

NZ Dollar Down on China’s Industrial Profits

The New Zealand dollar fell today after the report showed that profits of Chinese industrial companies declined, adding to signs of global economic slowdown and damping prospects for New Zealand exports. Industrial profits in China were down 5.4 percent in July from a year ago. China is the second largest trading partner of New Zealand. The Standard & Poorâs 500 Index lost 0.1 percent and S&P GSCI Index of commodities […]

Read more August 28

August 282012

Signs of Slowdown Spur Safety Demand, Yen Profits

The Japanese yen climbed today on signs of economic slowdown in various parts of the world, including Japan itself, that spurred demand for safer currencies. Currently, the yen shows signs of weakening. Japan’s government downgraded its economic outlook and noted that “weak movements have been seen recently”, mentioning the negative impact of “further slowing down of overseas economies and sharp fluctuations in the financial and capital markets”. The MSCI Asia Pacific Index of shares […]

Read more August 28

August 282012

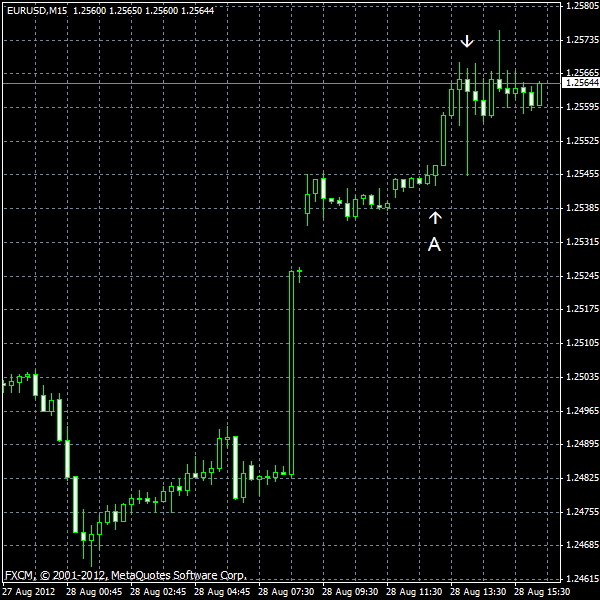

Hopes for Spain Push EUR/USD Higher

EUR/USD traded above the opening level today, following two session of decline, on speculations that Spain would get a bailout soon and as the country successfully performed its bill auction. The US fundamentals were mixed. Data confirmed that the US housing market is recovering, while manufacturing contracted with slower pace. At the same time, consumer sentiment unexpectedly worsened this month. S&P/Case-Shiller home price index rose from […]

Read more