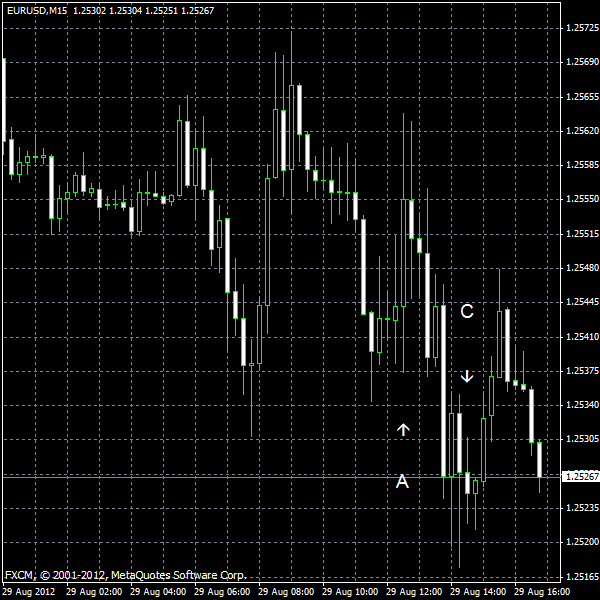

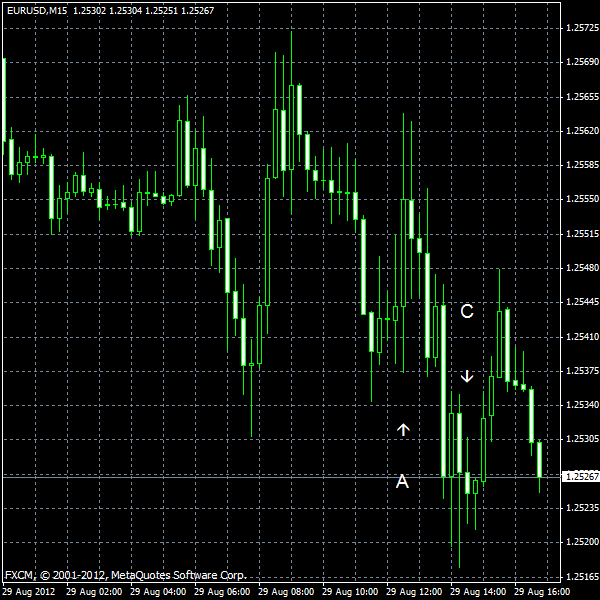

EUR/USD weakened today as the positive macroeconomic data from the United States reduced incentive for the Federal Reserve to ease its monetary policy. US economy continued to grow and the housing market showed signs of strength. Those who bet on quantitative easing from the Fed feel themselves less certain now.

US GDP rose 1.7% in the second quarter of 2012, matching forecasts. GDP expanded 2.0% in the first quarter. (Event A on the chart.)

Pending home sales grew 2.4% in July from June, when they fell 1.4%. The consensus forecast promised moderate growth by 1.1%. (Event B on the chart.)

Crude oil inventories increased by 3.8 million barrels last week and are above the upper limit of the average range for this time of year. Total motor gasoline inventories decreased by 1.5 million barrels and are in the lower half of the average range. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.