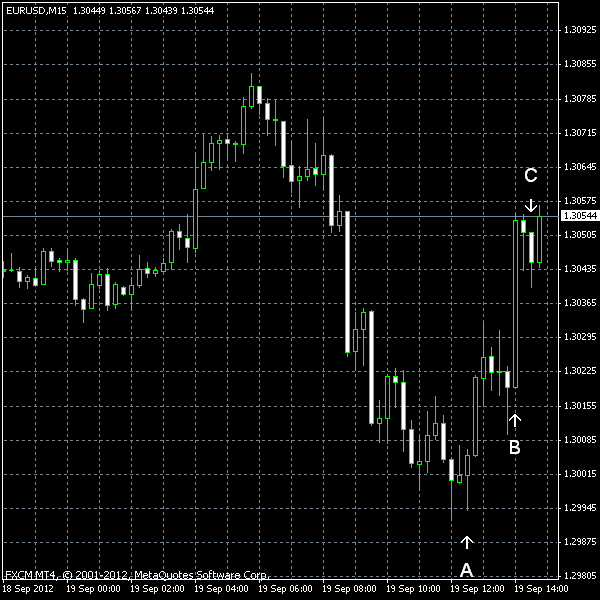

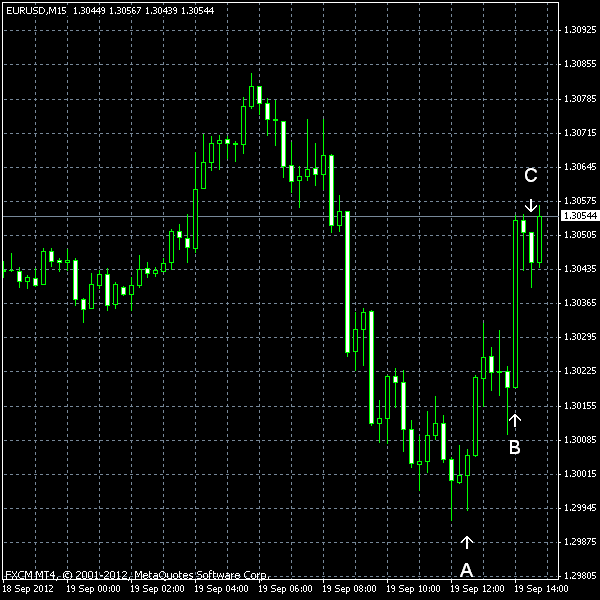

The euro stopped its fall against the US dollar today after unsuccessfully trying to continue this week’s trend. Two sets of housing statistics were released in the United States today and both have managed to move the EUR/USD up from its downward trend. The currency pair did not pay much attention to today’s oil inventories report by the US Department of Energy.

Housing starts went up from 733k (revised down from 746k) to 750k seasonally adjusted annual rate in August; they were expected to rise to 757k. Building permits declined from 811k (revised down from 812k) to 803k during the same period, while the median forecast pointed out a drop to 795k. (Event A on the chart.)

US existing home sales rose from 4.47 million to 4.82 million in August (seasonally adjusted annual rate). The report spurred

US crude oil inventories advanced by 8.5 million barrels during the week ending September 14, following a growth of 2 million barrel reported for the previous week. Total motor gasoline inventories decreased by 1.4 million barrels during the last week after posting a 1.2 million decline a week earlier. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.