- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: October 1, 2012

October 1

October 12012

Aussie Uncertain Ahead of RBA Decision

The Australian dollar was unable to produce a clear trend today ahead of tomorrow’s monetary policy decision of Australia’s central bank. Aussie’s performance against the euro was more defined as the shared 17-nation currency outperformed most of its trading peers, including the Australian currency. The Reserve Bank of Australia will announce its monetary policy decision tomorrow. Some analysts say that the bank will lower interest rates, while others […]

Read more October 1

October 12012

Higher Commodity Prices Lead to Gains of Loonie

The Canadian dollar advanced today as positive macroeconomic indicators and rising prices for raw materials supported demand for the currency tied to commodities. The loonie was unable to outperform the euro, which rallied on the positive news from Spain. The Raw Materials Price Index grew 3.4 percent in August, led by gains of oil prices. Crude did not disappoint today either, rising amid the positive market sentiment. Today’s favorable data added to optimism, […]

Read more October 1

October 12012

Japanese Yen Drops as Economic Data Remains Weak

Japanese yen continues to show weakness on the Forex market. With a measure of optimism returning to the markets and helping risk appetite, the yen is not needed as a safe haven. On top of that, weak economic data in Japan is also helping to keep the yen lower. Part of the yen’s weakness today comes from optimism in the markets. Stress tests of Spanish banks last week showed that things aren’t as bad as expected, with banks […]

Read more October 1

October 12012

US Dollar Mixed as Forex Traders Await Direction

US dollar is mixed today, performing differently against various majors as Forex traders await direction. There is economic data expected today, as well as a speech coming from Ben Bernanke. Right now, there is a bit of anticipation in the air. Forex traders are waiting for the latest economic data out of the United States, as well as a speech fro the Federal Reserve Chair, Ben Bernanke. Right now, the US dollar […]

Read more October 1

October 12012

Pound Down vs. Euro on Manufacturing PMI, Stable vs. Dollar

The unexpected decline of the UK manufacturing index led to drop of the Great Britain pound against the euro. Britain’s currency was little changed versus the US dollar and the Japanese yen. The Markit/CIPS UK Manufacturing PMI fell to 48.4 in September, while analysts expected it to be stable near 49.5. A value below 50.0 indicates decline of an industry. The report said that manufacturing contracted as “order inflows remained lacklustre and job losses continued […]

Read more October 1

October 12012

Stress Test of Spanish Banks Leads to Rebound of Euro

The euro climbed today as the results of Spanish banks’ stress test were better than expected, improving the outlook for the economy of the eurozone and its currency. According to the stress test, Spain’s banks have smaller capital deficit than was previously estimated. Moody’s Investor Service said that recapitalization of Spanish banks will be positive for the country’s credit rating. The shared European currency rose as a result of the good news and may climb even […]

Read more October 1

October 12012

ATC2012 Has Started!

The Automated Trading Championship 2012 has started today. Only 451 participants (out of more than 3,600 registrants) were admitted — others failed to submit either correct id information or a working expert advisor. With only 15 hours into the contest, the leading expert advisor (wlagor from Russian Federation) has already more than doubled its starting balance thanks to EUR/USD rally. With more than $11,000 […]

Read more October 1

October 12012

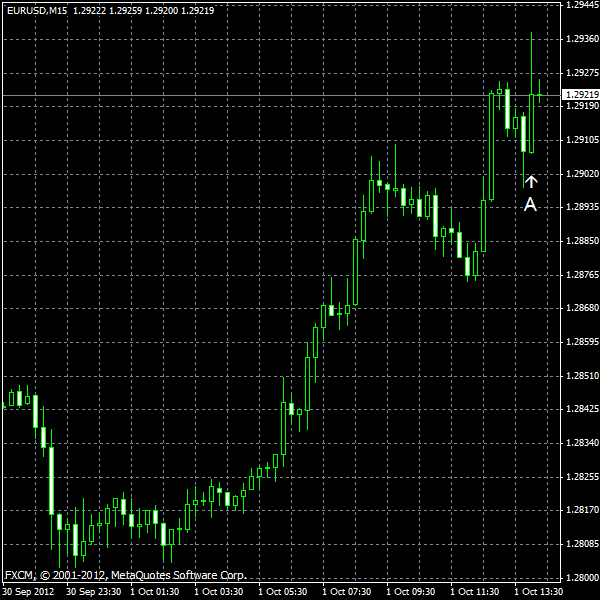

EUR/USD Rebounds as Negative Sentiment Retreats

EUR/USD is going to the upside today as the news from Europe was positive and economists say that the recent losses counted on much worse economic situation. The stress test of Spanish banks revealed that the capital deficit of banks was smaller than previously estimated. The euro was rallying amid the good news, experienced a small pullback in the middle of the trading session, but quickly resumed its upside move. ISM manufacturing PMI […]

Read more