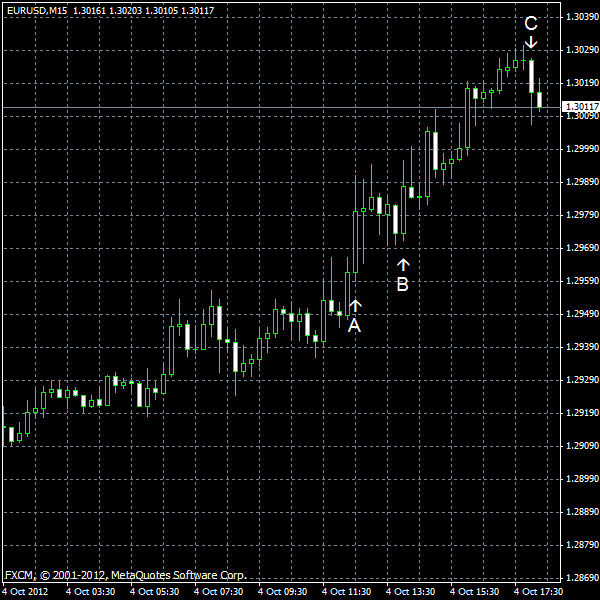

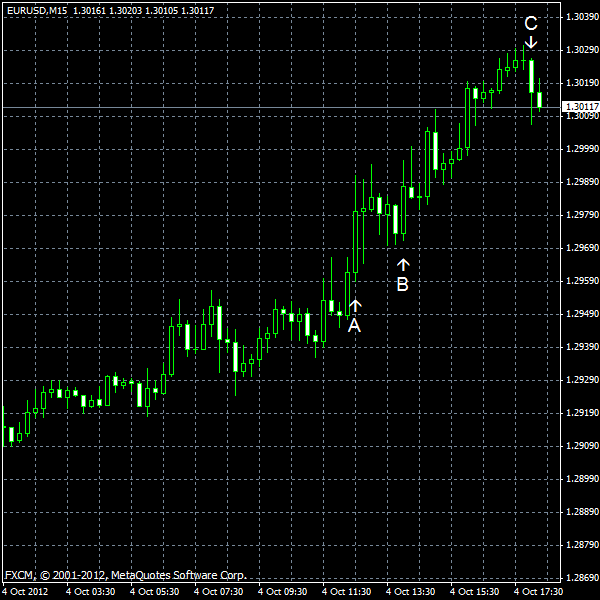

EUR/USD soared today after the European Central Bank kept its interest rates unchanged and ECB President Mario Draghi said on the

Initial jobless claims (seasonally adjusted) rose a little from 363k to 367k last week, being somewhat below the forecast value of 371k. (Event A on the chart.)

Factory orders fell 5.2% in August, declining for the second time in the last three months. The data was not as bad as the predicted 6.0% drop, but definitely worse than July’s increase by 2.8%. (Event B on the chart.)

The minutes of FOMC

policy meeting confirmed that most policy members view quantitative easing as a necessary tool for powering the US economy (event C on the chart):

Members generally expressed concerns about the slow pace of improvement in labor market conditions and all members but one agreed that the outlook for economic activity and inflation called for additional monetary accommodation.

If you have any comments on the recent EUR/USD action, please reply using the form below.