- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: October 5, 2012

October 5

October 52012

Nonfarm Payrolls Do Not Harm Dollar to a Great Extent

The US dollar closed somewhat lower against the euro today as favorable non-farm payrolls spurred a wave of risk appetite across the Forex market. The US currency managed to jump versus the Great Britain pound and retained its gains against the Japanese yen. The positive nonfarm payrolls turned the Forex, as well as other markets, to a risk-on mode. The Standard & Poorâs 500 Index of stocks rose 0.7 percent. The greenback felt some downside […]

Read more October 5

October 52012

Good Employment in US & Canada Pushes Loonie Higher

The Canadian currency jumped after positive employment data from the United States and Canada itself boosted the attractiveness of the loonie, though the currency gradually moves lower as of present time. Canada’s employers added as much as 52,100 jobs in September, the second consecutive month of employment growth. That is compared to the median forecast of 11,700 and the previous reading of 34,000. At the same time, the unemployment rate rose by 0.1 percentage point to 7.4 percent, while analysts […]

Read more October 5

October 52012

UK Pound Holds Its Own Against US Dollar

UK pound is holding its own against the US dollar, helped by a return to risk appetite. Without the general risk appetite, the pound would likely be struggling much more, as the British policymakers look for a way to boost the UK economy. Right now, things are a little slow going for the UK economy. Prime Minister David Cameron‘s latest plan has run into a regulatory roadblock, and there are concerns about […]

Read more October 5

October 52012

Euro Gains Against US Dollar on Spanish Bonds and US Jobs

Euro is heading higher today as better news helps spur risk appetite. Euro is finding support as the Spanish bond auction outperforms expectations, and as US jobs data shows improvement. Even though there are still concerns about whether or not Spain will as for a bailout in a reasonable amount of time, there has been some improvement in the situation. Spanish bonds outperformed, with prices rallying and yields falling. Indeed, […]

Read more October 5

October 52012

Dollar Jumps vs. Yen on Employment Data

The US dollar was little changed against the euro and jumped versus the Japanese yen after the US unemployment rate unexpectedly fell, while employment grew in line with analysts’ forecasts. Now, traders speculate what impact the data may have on Federal Reserve’s policy. The unemployment rate dipped from 8.1 percent in August to 7.8 percent in September. That was a pleasant surprise as specialists have feared that the rate would […]

Read more October 5

October 52012

Japan’s Central Bank Refrains from Additional Stimulus, Yen Steady

The Japanese yen remained steady today after the Bank of Japan kept interest rates unchanged and refrained from expanding its asset purchase program. Yesterday, the currency was weakened by expectation of an intervention from the BoJ. Japan’s central bank kept its main interest rate near zero, in line with forecasts, and refrained from additional asset purchases, which was a bit of surprise to analysts, who have thought that the bank […]

Read more October 5

October 52012

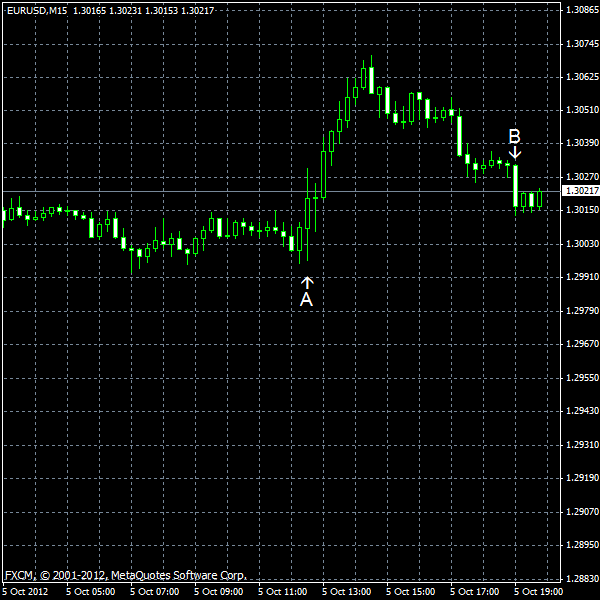

EUR/USD Surges on US Payrolls, Loses Gains

EUR/USD jumped to the highest level since September 19 today after the US unemployment rate unexpectedly dropped to the lowest level January 2009. Nonfarm payrolls showed robust growth and the previous reading, which was considered disappointing by traders, received a significant positive revision. Consumer credit was much higher than the forecast value. The risk sentiment turned positive today and traders preferred the euro to the dollar. Yet the shared European currency […]

Read more October 5

October 52012

Yen Weak Ahead of BoJ Meeting Results

The Japanese yen fell today to the lowest level in more than two weeks ahead of the Bank of Japan’s policy meeting. Economists expect that the central bank will add more stimulus, weakening the currency. The Bank of Japan will announce its policy decision later today. The bank boosted its asset purchase program on its previous meeting and analysts expect that it will do so again at today’s meeting. Japan’s […]

Read more