- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: October 23, 2012

October 23

October 232012

Slacking Global Growth Makes NZ Dollar Less Appealing

The New Zealand dropped today as worries that global economic growth is slacking deterred Forex market participants from riskier currencies. The kiwi reached the lowest level in more than a month against the US dollar. Spain’s economy contracted for the fifth consecutive quarter. The poor data followed the credit downgrade of five Spanish regions by Moody’s Investor Service. Europe became a bringer of bad news yet again. The United States were […]

Read more October 23

October 232012

Bank of Canada Remains Hawkish, Loonie Goes Higher

The Canadian dollar jumped today against the euro after the Bank of Canada maintained its key interest rate and issued a hawkish statement. The loonie was down against the yen as the Japanese currency was surprisingly strong today, following yesterday’s losses. The Canadian currency trimmed its decline versus the US dollar, but remained somewhat below the opening level. The BoC kept its overnight rate (the main interest rate) at 1 percent […]

Read more October 23

October 232012

UK Pound Loses Ground on Growing Risk Aversion

After seeing some increases earlier, the UK pound is back to losing ground as risk aversion rises. Concerns about global economic growth, and disappointments about earnings news from stocks, are weighing on the pound. Earlier, the UK pound got a boost from a decline in business delinquencies. Also, there was a little more risk appetite, and that was supporting the pound as well. Now, though, things have changed. Worries […]

Read more October 23

October 232012

Euro Falls as Moody’s Cuts Spanish Regions

The euro retreated today as Moody’s Investor Service downgraded credit ratings of several Spanish regions. The news added to tensions caused by uncertainty about the bailout for the indebted nation. Moody’s cut the ratings assigned to five Spanish regions (Andalucia, Extremadura, Castilla-La Mancha, Catalunya, and Murcia) by one or two notches. The rating agency explained its decision by “the deterioration in their liquidity positions, as evidenced by their very limited cash reserves as of September 2012 and their […]

Read more October 23

October 232012

Risk Aversion Boosts US Dollar as Stocks Drop

Earlier, risk appetite was helping high beta currencies in Forex trading. Now, though, risk aversion has appeared and that is sending the US dollar higher as traders look for safe haven. Risk aversion is returning to the currency market, thanks in large part to disappointing earnings in the United States. DuPont and RadioShack are among the companies that missed targets, and there are concerns about other companies right now. […]

Read more October 23

October 232012

Yen Rebounds Even Amid Intervention Speculations

The Japanese yen rebounded today even as investors continued to bet on an intervention from the Bank of Japan. Earlier, the currency reached the lowest level since July against the US dollar and the lowest since May versus the euro. Some economists claim that the BoJ may intervene as soon as the next policy meeting. Supporting such speculations, Japanâs Economy Minister Seiji Maehara said that he may join the meeting and attempt to convince the policy […]

Read more October 23

October 232012

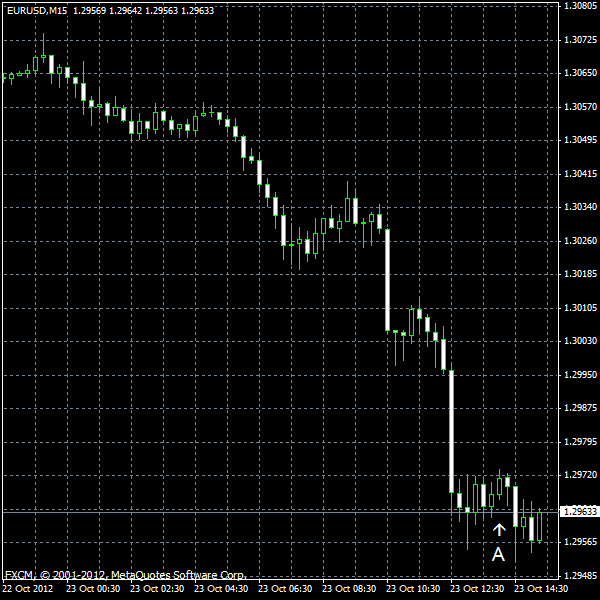

EUR/USD Resumes Downfall on Moody’s Downgrades

EUR/USD sank today, following yesterday’s gains, and resumed its downfall that had started on October 18. Moody’s Investors Service downgraded credit ratings of five Spanish regions, even though the rating agency maintained the sovereign rating of Spain itself last week. Adding to the negative sentiment, the US manufacturing index went unexpectedly to the negative territory. Richmond Fed manufacturing index fell to -7 in October, while it was expected […]

Read more October 23

October 232012

Pound Gains as Number of Business Insolvencies Decline

The Great Britain rose against the US dollar yesterday and continued to gain today as the number of UK business insolvencies fell last month. The sterling was also higher against the Japanese yen, but dropped versus the euro. Experian Plc reported that the number of business insolvencies dropped 3.1 percent in September from a year ago to 1,679 companies. Max Firth, the managing director at Experian Business Information Services, commented: Overall insolvency […]

Read more