- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: October 30, 2012

October 30

October 302012

Dollar Retreats as Risk Aversion Recedes

The US dollar fell today, following yesterday’s gains on risk aversion. Today, traders were a bit more courageous after Hurricane Sandy hit the United States and damage was assessed. Positive US fundamental data also dampened need for safer assets. Sandy made a landfall and some experts speculated that damage was smaller than was expected. Market participants anticipated more severe consequences and now are selling […]

Read more October 30

October 302012

Yen Attempts to Keep Gains Even as BoJ Eases Policy

The Japanese yen climbed today even as the Bank of Japan eased its monetary policy. The currency trimmed its gains against the US dollar later, though, and fell against the euro as the market sentiment turned to positivity. The BoJ expanded its asset purchase program by ¥11 trillion to ¥91 trillion. The central bank also talked about measures to overcome deflation. The yen jumped after the policy decision as Forex market participants the size of the additional […]

Read more October 30

October 302012

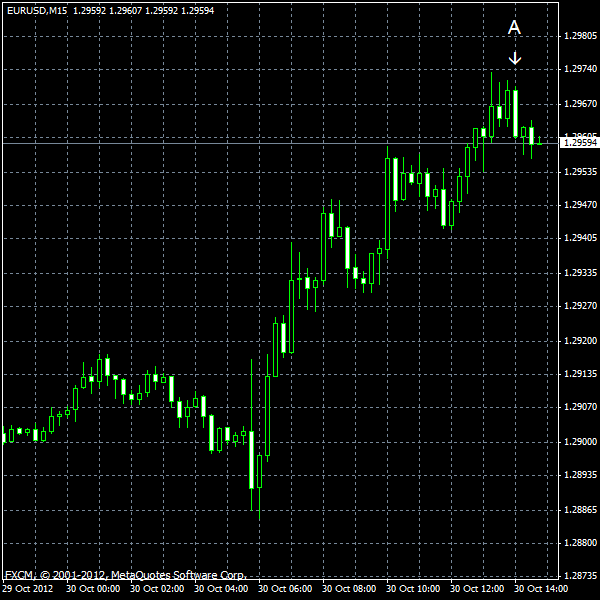

Euro Moving through Resistance

Euro is moving higher today, muscling through resistance even though the news out of the eurozone continues to disappoint. After bouncing off lows below 1.2900, euro touched a session high of 1.2966. Economic confidence fell to 84.5 in October, representing a drop from the revised 85.2. However, there were estimates of 84.4, so the slight improvement is helping the situation. Composite manufacturing and services continues to contract, with advanced PMI […]

Read more October 30

October 302012

Won Reaches 13-Month Record

The South Korean won climbed today, reaching the highest level in 13 months, probably because exporters sold dollars to convert their earnings after exports advanced. The Forex market sentiment improved today, adding to the bullish bias of the currency. South Korea’s current account balance posted a surplus of $6.07 billion in September, reaching the second highest level in history, due to rising exports. Exporters should have sold dollars to convert their […]

Read more October 30

October 302012

Chinese Yuan Reaches High Not Seen for Almost 19 Years

Chinese yuan is higher against the US dollar, gaining to its greatest value in almost 19 years. With so much weakness around the globe, pressure is high enough that China had little choice but to let the yuan appreciate. Earlier, the Chinese yuan (also called the renminbi) reached 6.2371 against the US dollar, an intraday high not seen since 1994, at the launch of China’s new currency trading […]

Read more October 30

October 302012

EUR/USD Erases Losses as Market Sentiment Turns Positive

EUR/USD rose today, erasing yesterday’s losses, as the Forex market sentiment improved. Previously, traders were worried as Hurricane Sandy threatened the United States, causing closure of US stock markets. The markets remained closed today, but damage from the cyclone was smaller than expected, making the trader’s mood improve. Signs that the US housing market continues to recover with increasingly faster pace added to the bullish momentum of the currency […]

Read more October 30

October 302012

Australian Dollar Trims Its Losses

The Australian dollar rose today following yesterday’s losses. The currency was weak on the previous trading session as the market sentiment was unfavorable for riskier assets. The Aussie gained against the euro and though trimmed its drop versus the US dollar. But the Australian currency continued to decline against the Japanese yen. There was no obvious reason for the change of performance and the rebound may be just temporary. The most noticeable reason for traders to be […]

Read more October 30

October 302012

CAD Trades Below Parity with USD

The Canadian dollar traded below parity with its US counterpart for the first time since August as the general negative sentiment on the Forex market added to fundamental concerns in Canada. The Forex market experienced risk aversion as Hurricane Sandy threatens the United States. The commodity market was hurt by the negative mood as well and the Standard & Poorâs GSCI Index of raw materials fell 0.4 percent. The performance of the Canadian dollar is linked to the commodity […]

Read more