- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: January 10, 2013

January 10

January 102013

Brazilian Real Rises Even amid Negative Domestic Fundamentals

The Brazilian real advanced today amid the positive sentiment created by the news from China and Europe, even as the data suggested that Brazil’s industrial output declined, spurring speculations that the central bank will keep interest rates record low. Brazil’s heavy-vehicle traffic declined 3.1 percent in December from a year ago and cardboard sales dropped 0.9 percent, suggesting that industrial production weakened. That may cause the Central […]

Read more January 10

January 102013

Rand Drops amid Labor Unrest in South Africa

The South African rand dropped today as concerns about the worker strikes overshadowed the positive trading data from China. The news from China boosted commodity currencies, but the local problems did not allow ZAR to profit from that. China’s exports rose in December more than was expected, resulting in the trade surplus of $31.6 billion, which was above the forecast of $20.1 billion. The Standard & Poorâs GSCI Index […]

Read more January 10

January 102013

US Dollar Drops as Risk Appetite, Gold Rise

US dollar is dropping today, heading lower as risk appetite makes an appearance, and as gold rises, putting downward pressure on the greenback. For now, there is optimism, and that is helping currencies like the euro and the Aussie against the US dollar. The latest news out of China is an unexpected trade surplus. This news has been helping risk appetite today, since the thought is that China will be able […]

Read more January 10

January 102013

BOE, As Expected, Stays the Course

The Bank of England has, as expected by most analysts, decided to stay the course on interest rate policy and the current asset purchase program. The news has led to very little change on the Forex market, with the pound still weak against the euro, but gaining against the US dollar. Today’s Bank of England announcement was to keep the interest rate at 0.5 per cent, while keeping the asset purchase program steady at 375 billion pounds. […]

Read more January 10

January 102013

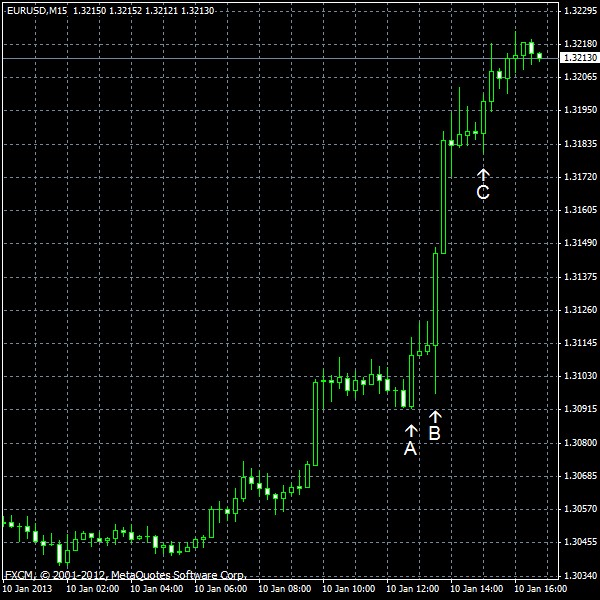

EUR/USD Surges as ECB Refrains from Interest Rate Cut

EUR/USD soared today after the European Central Bank kept interest rates unchanged (event A on the chart) and bank’s President Mario Draghi said that he expects the European economy to improve in 2013 (event B on the chart). The news from Europe added to optimism caused by the good trading data from China, driving the dollar down. The news from the United States was not that favorable as unemployment claims unexpectedly rose. Initial […]

Read more January 10

January 102013

NZD/JPY Reaches Record High Since 2008 as Stocks Rally

The New Zealand dollar advanced yesterday and kept its gains today as optimism returned to the Forex market and stocks rallied on hopes for corporate earnings in the United States. The currency reached the highest level since 2008 against the Japanese yen. The Standard & Poorâs 500 Index of shares rose 0.3 percent yesterday. Analysts estimated that earning of S&P 500 companies increased as much as 2.9 percent last quarter. The MSCI World Index […]

Read more January 10

January 102013

Yen Ends Rally on Speculations About Inflation Target

The Japanese yen retreated today after the two-day rally on speculations that the government will convince the Bank of Japan to double the inflation target, adding to the pressure on the currency. BoJ Governor Masaaki Shirakawa said that the central bank works in close contact with the government. Prime Minister Shinzo Abe was already calling for increasing the inflation target and more aggressive monetary policy for some time. Indeed, the bank mentioned aggressive policy during […]

Read more